Let’s Talk.

Start with a conversation. From there, we can build a plan.

Businesses used to need to be physically present in a state before they were subject to its tax laws. This is no longer the case. With the internet changing the nature of sales, laws are changing to acknowledge the new reality. The Supreme Court has overturned the requirement for a physical presence to collect sales tax online. Economic and virtual connections to a state are enough to constitute “nexus” according to the ruling in South Dakota v. Wayfair, Inc.

Experts expect a sea change in eCommerce. The District of Columbia plus 31 states now have online sales taxes for every purchase made from their state. Do I need to charge sales tax on my website?

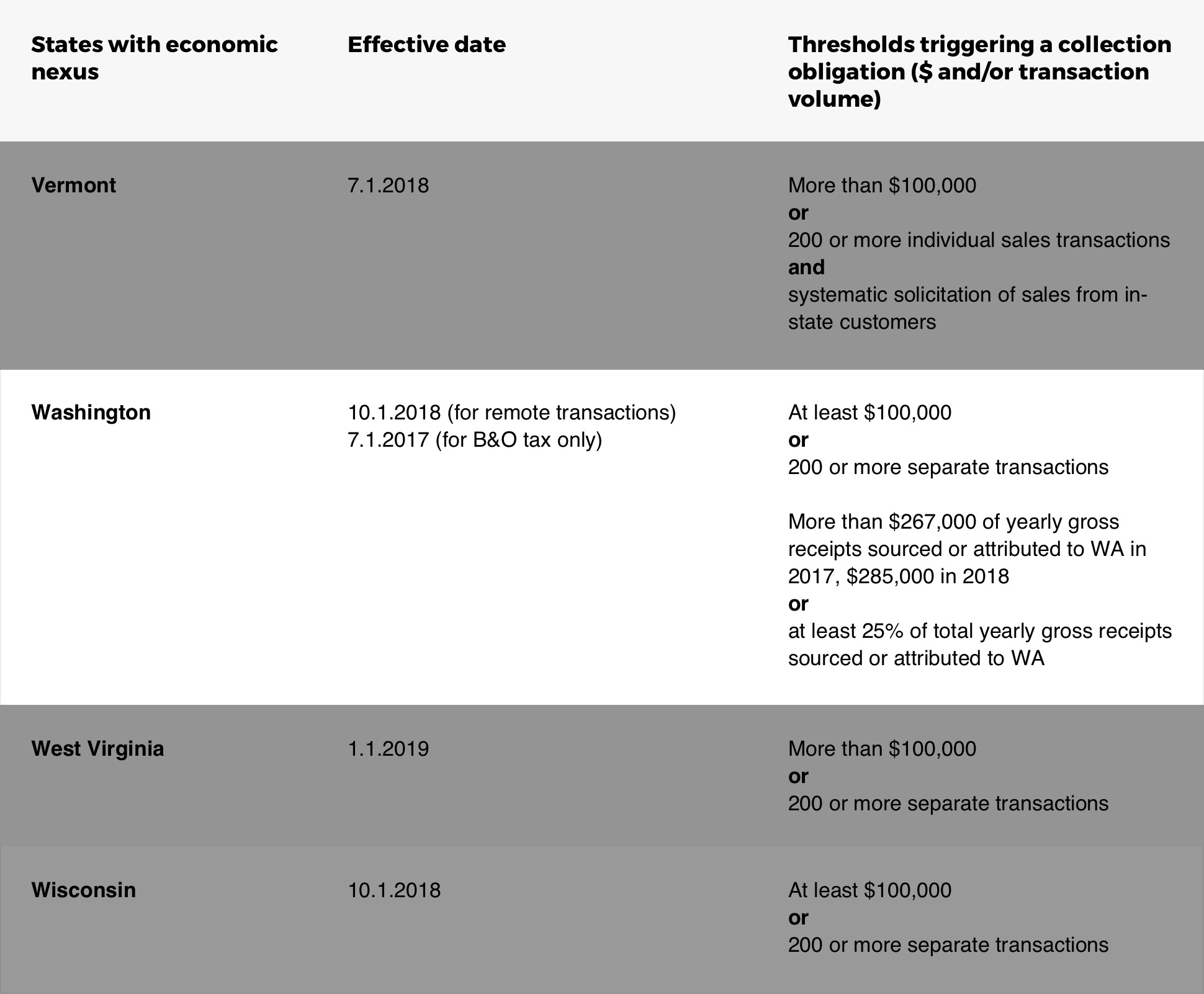

All businesses selling online to customers in Washington must obey the new rules. The eCommerce sales tax rules in Washington took effect on the first of October of 2018. These will not pertain to small retailers, but any sales in excess of $100,000 will trigger the obligation to collect sales tax online.

If a business does not generate over $100,000 in sales but has 200 or more separate sales transactions, they will also have to collect the online sales tax. Furthermore, if at least 25% of total yearly gross receipts are attributed to Washington, the business must collect the online tax.

One of the biggest threats to profit are compliance costs. Some companies hire several employees to keep track of these and remain on the right side of regulations. This process, however, is time-consuming. The business world moves fast and compliance can be an anchor holding your company back.

The process is also prone to error when done by hand. With all the thousands of tax jurisdictions and all their myriad and varying rules and regulations, it can become a monumental hassle to keep track of and collect sales tax online. Washington online sales tax rules are not necessarily the same as other states, and municipalities in Washington can have their own rules and regulations that coincide with the state standards. If a department makes a single mistake it can cost the company thousands of dollars in fines.

Sales tax automation can make the whole endeavor easier for everyone. Computers streamline the process, cutting back on labor hours and keeping costs down. Avalara has taken this burden off the shoulders of over 20,000 businesses worldwide and has become a trusted name in the industry.

Avalara’s specially designed software integrates with your business seamlessly, eliminating the need for paperwork in keeping track of online sales tax. It automatically makes the right decision each time a sale is generated, and it does this for over 12,000 jurisdictions all across the world, and for millions of products and services.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.