Let’s Talk.

Start with a conversation. From there, we can build a plan.

For years, the requirements for collecting and remitting state sales tax were determined by nexus – a business’s physical presence in a state. In fact, the term was interchangeable with “reasonable physical presence” and meant, simply, that a business must have a physical presence such as one or more employees, a warehouse, or a storefront in any given state in order to charge and remit the state’s sales tax. The definition was challenged and upheld in Quill Corp. v. North Dakota (1992) and until recently, dictated which businesses were required to collect sales tax online. With the advent of internet sales, however, many states called for a change.

South Dakota v. Wayfair, Inc. (2018) established the concept of economic state sales tax nexus. Simply put, businesses having a substantial economic presence in a state are required to charge and remit state sales taxes regardless of whether or not there is a physical presence. Many online businesses sell products in multiple states and may be affected by the changes brought about by this ruling.

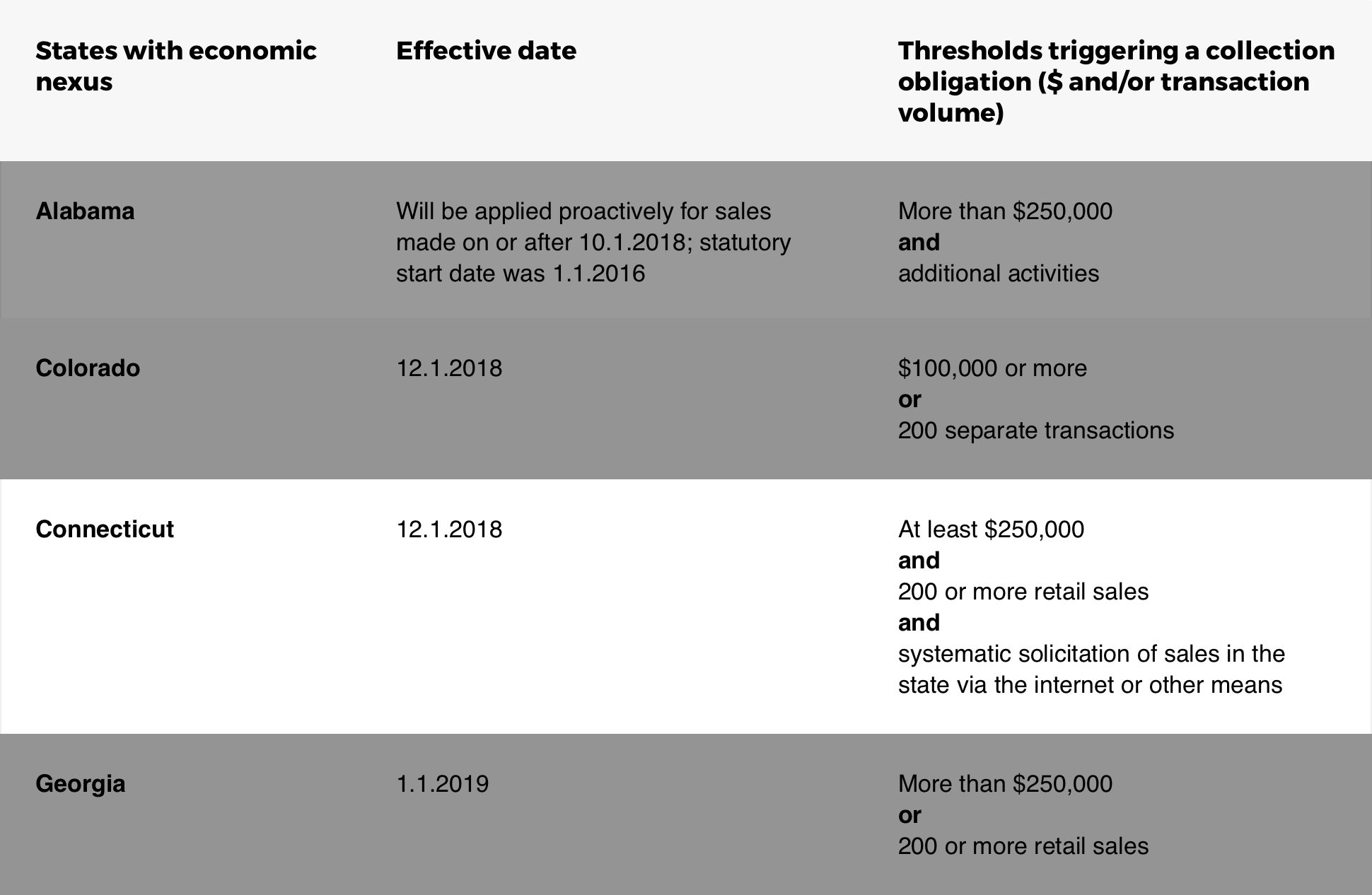

Some states had previously enacted economic nexus laws and had already changed the tax requirements for online businesses. Others established their own laws as a result of the Wayfair ruling, and still others will take effect in 2019. Since states individually determine the thresholds required for state taxes, it is more important than ever that online retailers stay up to date with current nexus laws.

New eCommerce sales tax rules in Connecticut took effect on December 1, 2018. Current Connecticut law states that in order to collect sales tax online, a business must meet all of the following criteria:

All of the thresholds must be met in order to collect state sales tax in Connecticut. If at any time, sales do not meet $250,000, fall below 200 sales, or if the business does not solicit regular sales in the state, the business may not be required to collect or remit state sales tax. According to eCommerce sales tax rules in Connecticut, this sales solicitation can take place by billboard, catalog, flyer, magazine, television, mail, radio, internet, or others.

If you sell tangible products online and meet all of the above qualifications for revenue, sales transactions, and sales solicitations, you will need to collect sales tax online in the state of Connecticut. However, each state has determined its own set of regulations regarding sales tax economic nexus thresholds, and you should be aware of changes as they occur. Avalara can help keep you informed and offers products to make fulfilling your tax obligations as easy as possible.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.