Let’s Talk.

Start with a conversation. From there, we can build a plan.

Colorado sales tax rules for online sales were previously based on the Supreme Court ruling in Quill Corp. v. North Dakota (1992) – in which businesses were required to have a nexus, or tie, to a state in order to charge and remit state sales tax. This nexus specified that businesses having a physical entity such as a building, warehouse, or at least one employee within a state would also be required to charge and remit sales tax.

The advent of online shopping caused many states, as well as the federal government, to rethink the way sales tax nexus was approached. Over the years, a few states enacted individual state sales tax laws for online businesses but it wasn’t until the Supreme Court overturned Quill v. North Dakota that widespread changes involving nexus occurred, truly affecting the way sellers collect sales tax online.

South Dakota v. Wayfair, Inc. (2018) established the concept of economic state sales tax nexus. Essentially, businesses having a vested economic presence in a particular state are now obligated to charge and remit state sales taxes regardless of the extent of their physical presence. As a result, many online retailers are affected and will need to determine their status in each state.

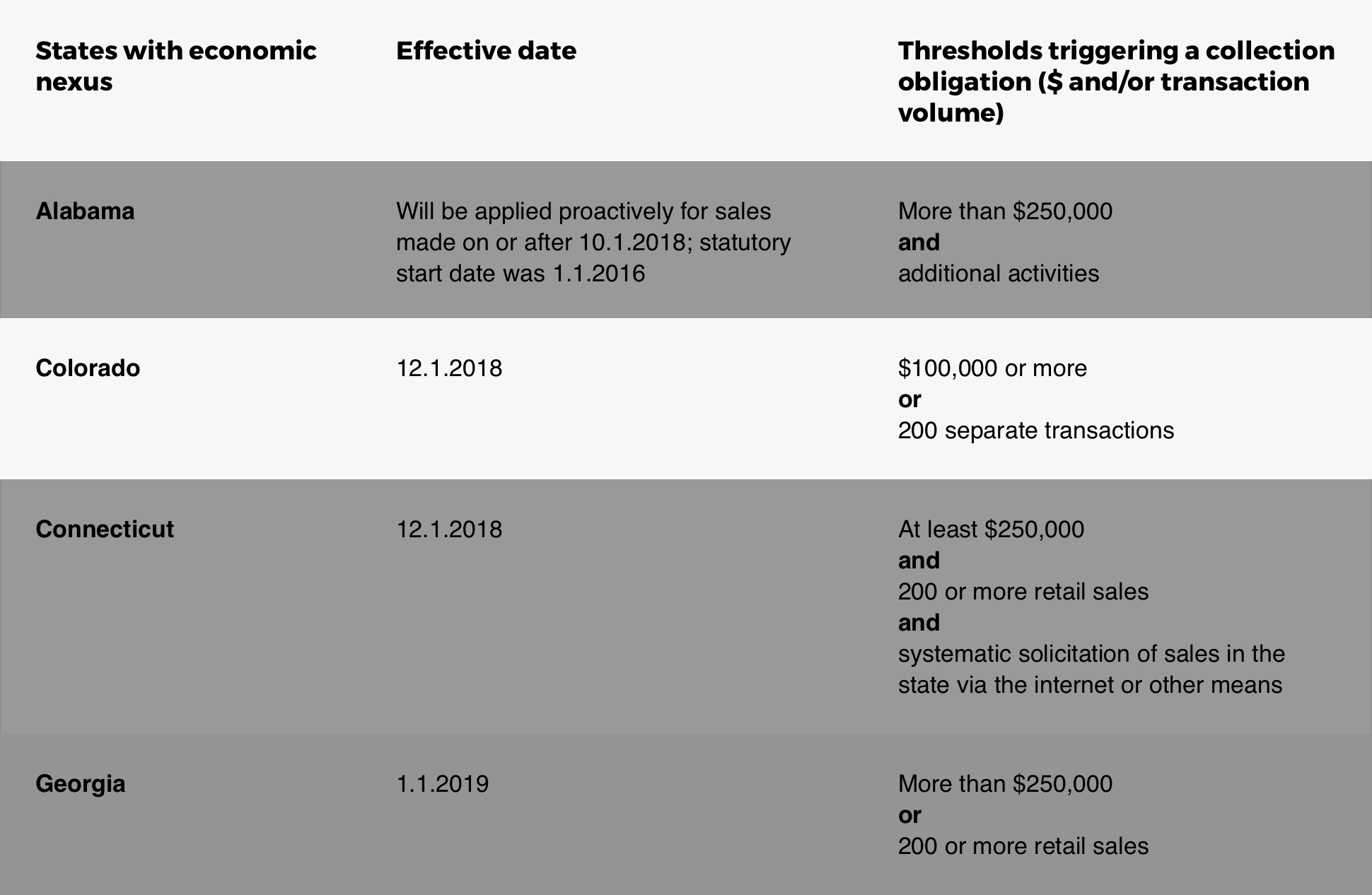

The Wayfair ruling served as a start date for many states that already had economic nexus laws. Other states enacted new laws soon after with a large range of effective dates, while Tennessee’s is still under injunction. It is essential that online retailers stay up to date as these laws go into effect, as each state has its own threshold for requiring sales tax.

New ecommerce sales tax rules in Colorado became effective as of December 1, 2018. However, there is a grace period in effect, which lasts until June 1, 2019. Current Colorado law states that to collect sales tax online, a business must cross either of the following thresholds:

Only one of the thresholds must be met in order to result in Colorado state sales tax economic nexus. Two hundred or more transactions resulting in revenue below the $100,000 threshold would still require the business to charge state sales tax, and any business with online revenue over $100,000 will be required to remit state sales tax regardless of how many transactions occurred.

If your online business sells products in Colorado and meets one of the above qualifications, you will need to collect sales tax online and apply for a sales permit in the state. Other states have established different thresholds and criteria and your tax obligation in those states may be different, making up-to-date knowledge of economic nexus laws key. Avalara can assist you in answering that crucial question – “Do I need to charge sales tax on my website?”– and offers a streamlined solution to make sure your business is in compliance.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.