Let’s Talk.

Start with a conversation. From there, we can build a plan.

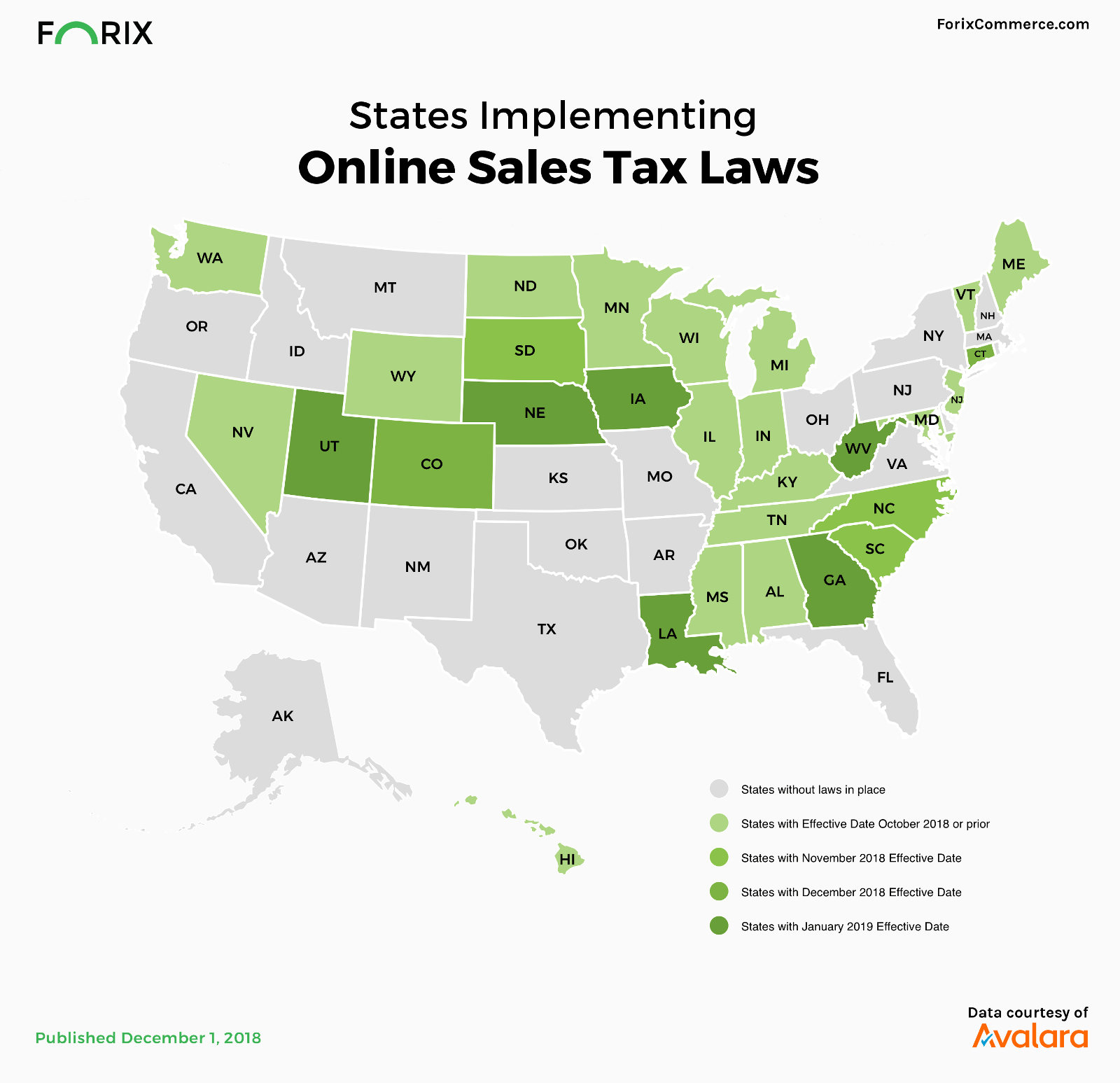

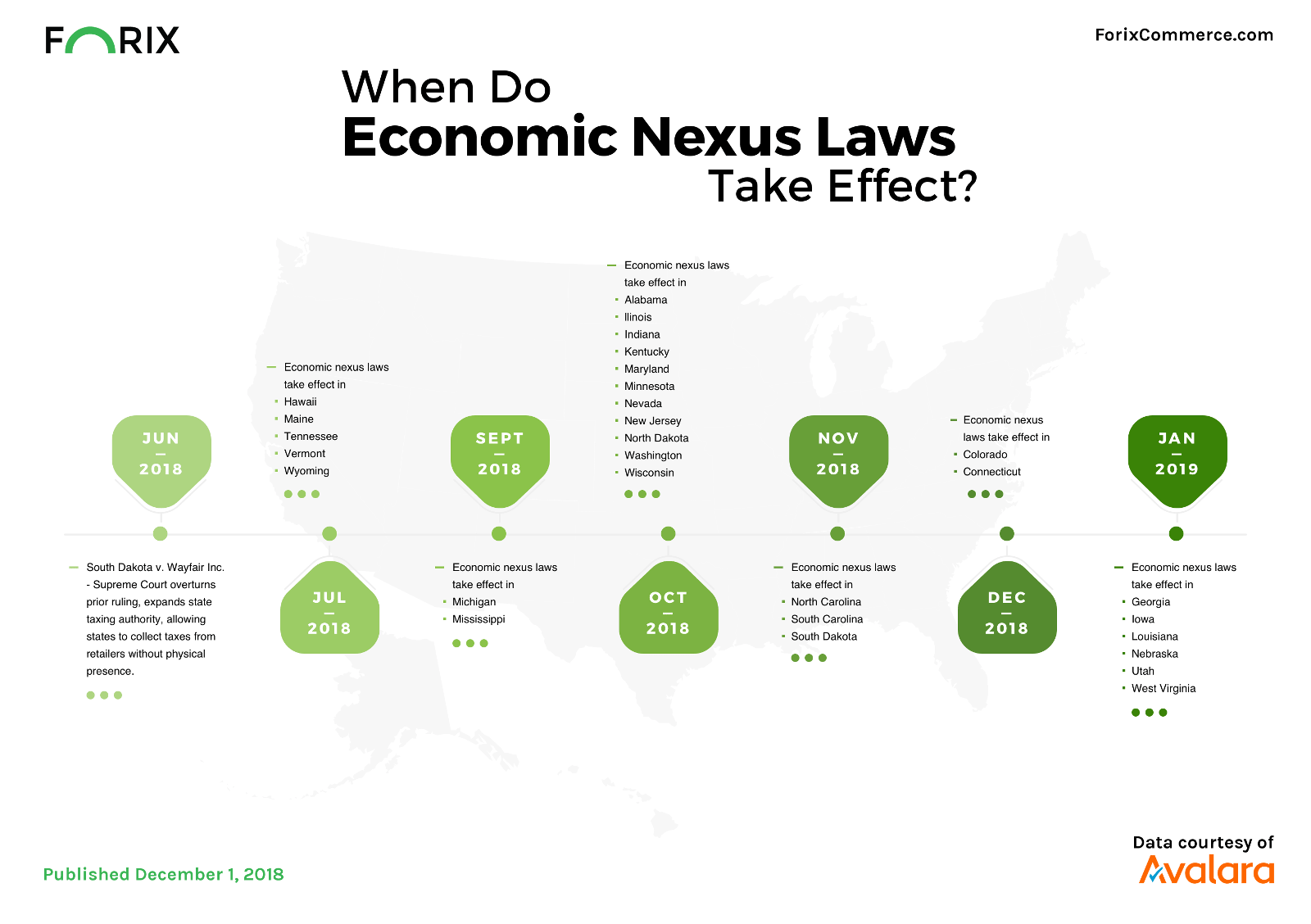

By now, most vendors have heard about the changes in sales tax rules implemented after South Dakota’s victory in South Dakota vs. Wayfair, but they may not understand the implications for their online businesses, especially considering how it may affect other states. Many states still haven’t changed their sales tax rules, but they will likely do so soon.

This decision has created a ripple effect throughout the world of eCommerce and the sales tax Magento sellers abide by. Magento online tax has been affected in the same way that all eCommerce outlets have. Still, it isn’t easy to keep up with how the Magento 1 online tax and Magento 2 online tax rules pertain to you.

Before this ruling, the law only required businesses with a warehouse, storefront, or physical presence to collect and remit sales tax. Companies selling online benefited greatly from this situation, but the Wayfair ruling is changing the eCommerce landscape. To avoid confusion and lack of compliance, talk to the team at Forix for help with tax plug-ins. Tax automation plug-ins use a real time tax calculation to assist eCommerce merchants who need to collect sales tax on Magento. If this whole process seems overwhelming, Forix can help. Trust our team to create a seamless integration process that ensures accuracy across business types and locations.

Moneys lost from uncollected sales taxes were estimated to be close to $33 billion annually. In the past, customers were responsible for paying this money to the state. Now, if the customer doesn’t pay, it’s the seller’s responsibility. The justice’s decision attached several new clauses that protect the state from making multiple online sales tax rules.

The goal was to prevent confusion in online retail due to loopholes that would mean a lack of revenue for the state. The justices stated in the ruling that this change protects those who do limited business in South Dakota.

In the simplest terms, the state is prevented from applying a large online sales tax to retailers who may not base their business in one state, but who do have a few retail customers in that state. What may be further challenging to online retailers is that South Dakota’s tax system was allowed to apply online sales tax retroactively to businesses that were not previously collecting it.

A case such as this one was bound to shake things up for eCommerce merchants eventually, especially with holiday shopping on the horizon. Even before the ruling, configuring Magento 1 online tax and Magento 2 online tax was no easy feat. With the new implication of the Wayfair decision, it’s even more crucial to collect sales tax on Magento and remit taxes with Magento as well.

Though these changes are likely to be difficult for online retailers, it’s not an unexpected ruling. At this point, the laws are finally catching up with technology, so it’s likely these laws are here to stay – and will impact other states. Though each state’s tax code is different, the wave of online business throughout the nation means that you should expect changes no matter where your online store is. If you’re concerned about compliance in the wake of this decision, it’s best to prepare early – even if your state has initiated changes.

We will break down some of the ways states will tax eCommerce merchants, while offering easy and legal solutions for properly collecting sales tax.

So, How Do You Collect Sales Tax on Magento Websites? What About Remitting Taxes?

First, it’s important talk about who you have to collect from. When it comes time to collect Magento 1 online tax, Magento 2 online tax, Magento open source online tax, and Magento commerce online tax, there are differences in each. Additionally, a merchant doesn’t have to collect from a state in which he or she doesn’t have sales tax nexus. Sales tax nexus can be defined as a certain threshold number of buyers within a state or could be created by a company holding employees or property in that state.

Essentially, you do not have to collect sales tax on Magento (any version) if you do not do a certain amount of business in a given state. Different states define the threshold of tax nexus differently. For example, doing $100k of revenue or 200 units sold might be the threshold for nexus in one state, but $200k or 100 units might be the starting point in another state.

A nexus is the determining factor for whether out-of-state businesses that are selling products into a state are liable for collecting sales tax. Being a nexus is required before states can impose taxes on a business. Click-through nexus pertains specifically to online merchants. Click-through legislation generally requires remote sellers meet a minimum sales threshold of their business from an in-state referral agent. Sellers must make commission payments to the in-state resident for orders that come through the click-through referral.

To get a start on compliance, talk to our team. A few simple steps ensure that you understand how to correctly collect sales tax on Magento:

Destination vs. Origin States

Most states levy taxes based upon the tax rate of the product’s ultimate destination, as opposed to the state of origin from where the product is sold or shipped. However, this isn’t true in every state as it pertains to sales tax on Magento. For example, businesses located in an origin-based tax state like Texas would collect sales tax on Magento from the buyer at your local rate, regardless of where the product was purchased and is being shipped.

If the business is in a destination state, it’s the opposite – the seller must collect sales tax at the rate of the destination locality, regardless of the local rate where the business is located. The buyer will pay a varying tax rate, depending on the businesses location and their own location.

At the end of the day, it’s imperative to comply with all the tax rules of any state where you are doing or intend to do business. This can be an arduous and tricky task, since municipalities may create their own tax rules and thus your business may potentially have thousands of different tax situations to keep track of. This is where a tax automation solution in can help alleviate the burden of running an online business, by taking this tracking off your plate.

Tax Automated Plug-Ins

If you are researching how to understand the sales tax Magento collects, you are probably already familiar with Magento sales tax integration, though perhaps not its complexities. Your business doesn’t have to spin its wheels working through those complexities. Forix can integrate your Magento eCommerce site with a powerful tax automation solution called Avalara.

Avalara helps you navigate the rapidly changing rates and rules with a plug-in that does the heavy lifting for you with real time tax calculation – a life-changing option for online merchants. It integrates seamlessly with your existing business applications for ultimate accuracy and ease of use. It also ensures compliance. You also can trust its accuracy as the laws evolve.

A Sign You Should Consider Avalara

Tax-automation plug-ins are becoming a necessary part of the lives of every digital merchant, but it is especially important to invest in real time tax calculation software to collect sales tax on Magento if your business is booming.

Here are a few reasons your tax requirements could be changing under your feet, confirming your need for tax help:

On a closely related but more specific note, here are some of the ways that a nexus can be triggered, changing your online retail shop’s taxes:

For all these scenarios and several others, it’s important to know the need for collecting taxes in new areas as your business grows. With Avalara, you can get eyes on the Magento sales tax tables. You will gain a clearer understanding, while the plug-in does the work.

What Does An Automation Program like Avalara Offer Your Business?

It may already be obvious that this software, or something similar, feels like a necessity for your business. Likely – it is. Still, it’s important to understand just what you are getting when you’re ready to track Magento 1 online tax, Magento 2 online tax, Magento open source online tax, and Magento commerce online tax with ease. Here are some of the benefits you can expect from Avalara:

To learn more about automation programs, you can check out this guide to sales and use tax created by the experts at Avalara.

Why It Matters

You may be thinking, “Sure, these programs sound convenient… but can I get by without them?” The answer is, yes, you probably could… but you shouldn’t.

The laws surrounding collecting sales tax on Magento and other eCommerce platforms are going through a season of change; don’t expect them to be decided on with this one ruling; they may not be completely clear cut for quite some time.

With evolving legislation, it’s far too much information for anyone to keep up with without relying on automated assistance. Failure to comply with the tax regulations in the states where you have nexus can result in hefty fines across multiple state lines. Worse yet, you could be audited – an expensive process that can result in major fines, even criminal penalties in some cases. With help from Forix, your integration not only will be compliant, it will be seamless – you can simply keep your business running by creating your product or service.

For small businesses, these are risks you likely can’t (and shouldn’t) afford to take – and you don’t have to. Luckily, Forix offers tax integration solutions like Avalara to create an easy, streamlined process for the automation of collecting Magento 1 tax, collecting Magento 2 tax, or collecting Magento open source online tax. Stay in compliance and ahead of the curve when you work with Forix, no matter where you sell or where your online business is located.

Start with a conversation. From there, we can build a plan.