Let’s Talk.

Start with a conversation. From there, we can build a plan.

A 1992 Supreme Court ruling in Quill Corp. v. North Dakota established sales tax nexus as a company’s physical tie to a state, requiring it to both charge and remit state sales tax in that state. In other words, a business with a storefront, warehouse, one or more employees, or other presence in the state was required to charge and remit sales tax there.

In the years since, online sales have skyrocketed, causing some states to form their own alternate definitions of nexus and subsequent laws regarding the application of state taxes. South Dakota v. Wayfair, Inc (2018) was a significant case that resulted in the Supreme Court overturning its prior decision that a business’s ties to a state must be physical. Instead, the Court determined that a business selling products online to the residents of a particular state may establish a nexus on an economic basis, and is subject to state economic nexus sales tax laws.

Thirty-One States Recognize Economic Nexus

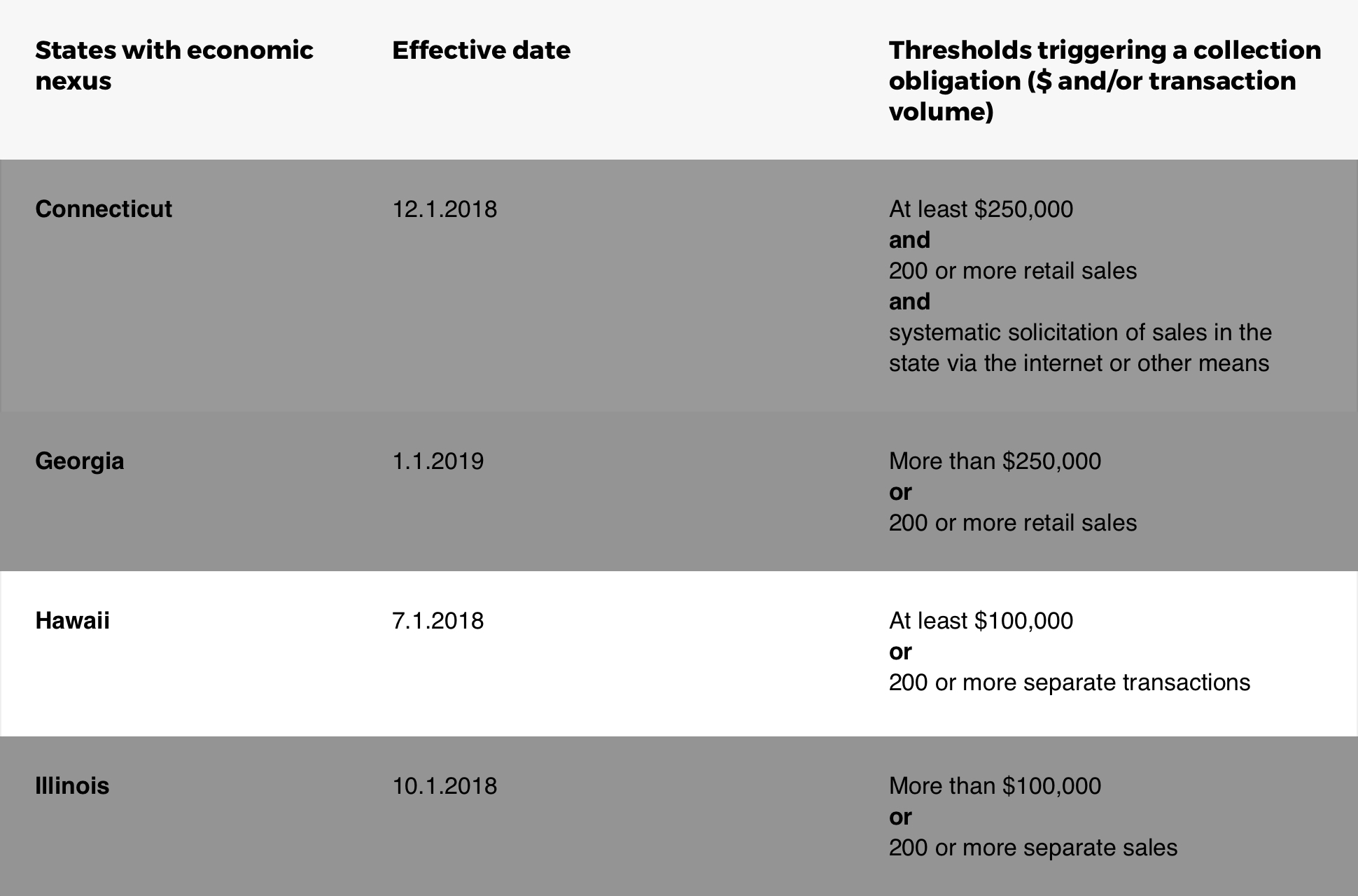

Although some states had already passed economic nexus laws, many used the 2018 Wayfair ruling as a start date for enforcing these laws. Other states chose to wait until 2019 or for further legislative action to enact their own laws. Each state determines its own thresholds and other requirements for economic nexus, and staying up to date as the various laws take effect is key.

New ecommerce sales tax rules in Hawaii took effect on July 1, 2018 and may still have online sellers asking themselves – “Do I need to charge sales tax on my website?” According to Hawaii tax law, in order to collect sales tax online within the state, a business must cross one of the following thresholds:

Keep in mind that a business needs to meet only one of the above two qualifications in order to be required to collect state excise taxes, which Hawaii collects in lieu of sales tax. A business making two hundred or more transactions resulting in revenue under $100,000 would still collect the Hawaii general excise tax. In the same way, revenue exceeding $100,000 crosses the threshold regardless of the number of transactions processed.

How Is Your Business Affected?

If you own an online business that sells tangible products in Hawaii and meets one of the above qualifications, you will need to collect sales tax online. Since thresholds vary widely among states, your tax obligations will differ from state to state as well. Avalara’s range of services and qualified tax specialists can aid you in interpreting Hawaii online sales tax rules to ensure your business stays in compliance.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.