Let’s Talk.

Start with a conversation. From there, we can build a plan.

Before 2018, state sales tax was determined by nexus – a purely physical definition of a business’s ties to a state. If the business maintained employees, a brick and mortar storefront, or a warehouse in a particular state, it was required to charge and remit state sales tax there. However, with the growth of internet-based sales, many felt online sellers were not taxing properly, and several states passed laws as a result.

These laws attempted to establish an economic nexus, rather than physical. If a company did enough business within a state to make a certain amount of revenue or sales there, they would establish an economic tie to a state just as strong as a physical nexus. With a lack of a federal ruling on such laws, though, many states did not enforce their laws.

South Dakota v. Wayfair, Inc. (2018) was a landmark decision for Nebraska online sales tax rules. The Supreme Court overturned the previous ruling stating that businesses must have a physical presence in a state and agreed that economic nexus provided a justifiable tie between an online seller and a state in which it sells. As a result, businesses selling online are subject to the online sales tax rules in the state of each customer.

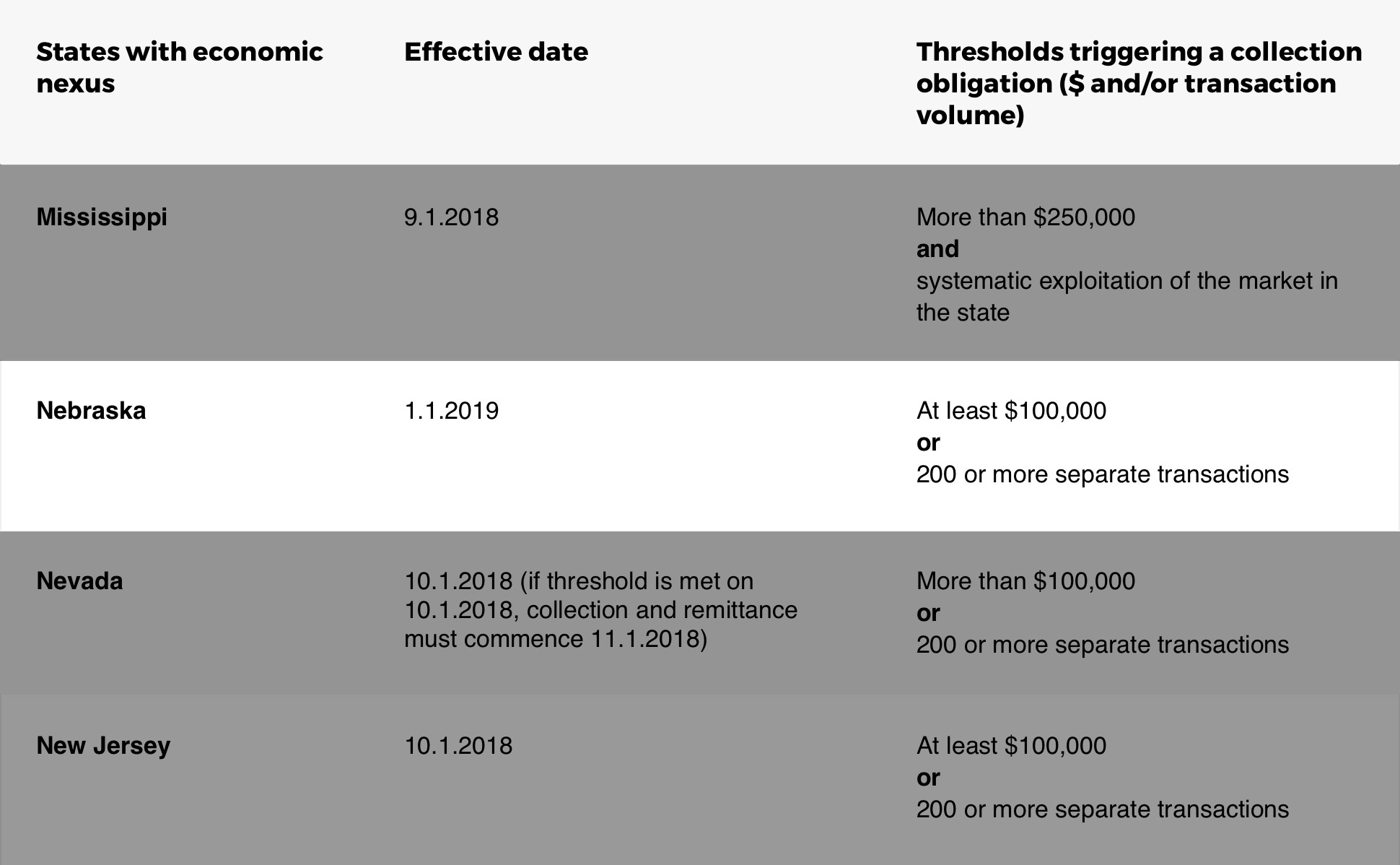

After the Wayfair case, many states that had previously passed nexus laws began to enforce them, while some states passed new laws. Still others are waiting for action by Congress to introduce laws or enforce current ones. Currently, 31 states have new or updated laws establishing economic nexus for online sellers, including Nebraska.

For a comprehensive list of all 31 states and their respective revenue or transaction thresholds, see Avalara’s state nexus law page here.

Nebraska is a state that has enacted new eCommerce sales tax rules, which became effective January 1, 2019. The law states that, in order to collect sales tax online in Nebraska, a business must reach one of the following thresholds for the previous calendar year:

These thresholds are not dependent on each other. In other words, a seller must meet only one of the requirements in order to charge and remit sales tax in Nebraska. A business making over $100,000 in revenue regardless of the number of transactions or completing 200 or more sales even if $100,000 in revenue is not reached is still considered eligible for state sales tax.

If you sell a tangible product in the state of Nebraska and meet one of the thresholds above, you will need to charge and remit sales tax for Nebraska. However, as mentioned, other states have different thresholds, varying laws, and an even wider range of effective dates for each. A tax professional like Avalara has the tools you need to make sense of the new laws and ensure your business is compliant in each and every state you do business.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.