Let’s Talk.

Start with a conversation. From there, we can build a plan.

Sales tax nexus has been a buzzword among online sellers in the past year, and for good reason – changes to laws surrounding the very definition of the term have meant widespread changes in the way online sellers determine sales tax. Being aware of the implications of recent changes in tax laws is essential for any online seller.

Prior to 2018, nexus was defined as a business’s physical tie to a particular state, and could include employees, a storefront or a warehouse. This definition was based on the Supreme Court case Quill Corp. v. South Dakota (1992) which ruled that businesses must establish a nexus, or tie, to a state. The dawn of online shopping, however, forced some states to rethink the definition of nexus in order to collect sales tax online.

Without a physical presence in a state, online sellers were not obligated to collect or remit state sales tax. In response, some states enacted their own laws, arguing that a strong enough economic nexus in the state should require state taxes, as well. However, most of these laws were not enforced until a 2018 Supreme Court decision in the South Dakota v. Wayfair, Inc. (2018) case overturned the strict physical nexus requirements.

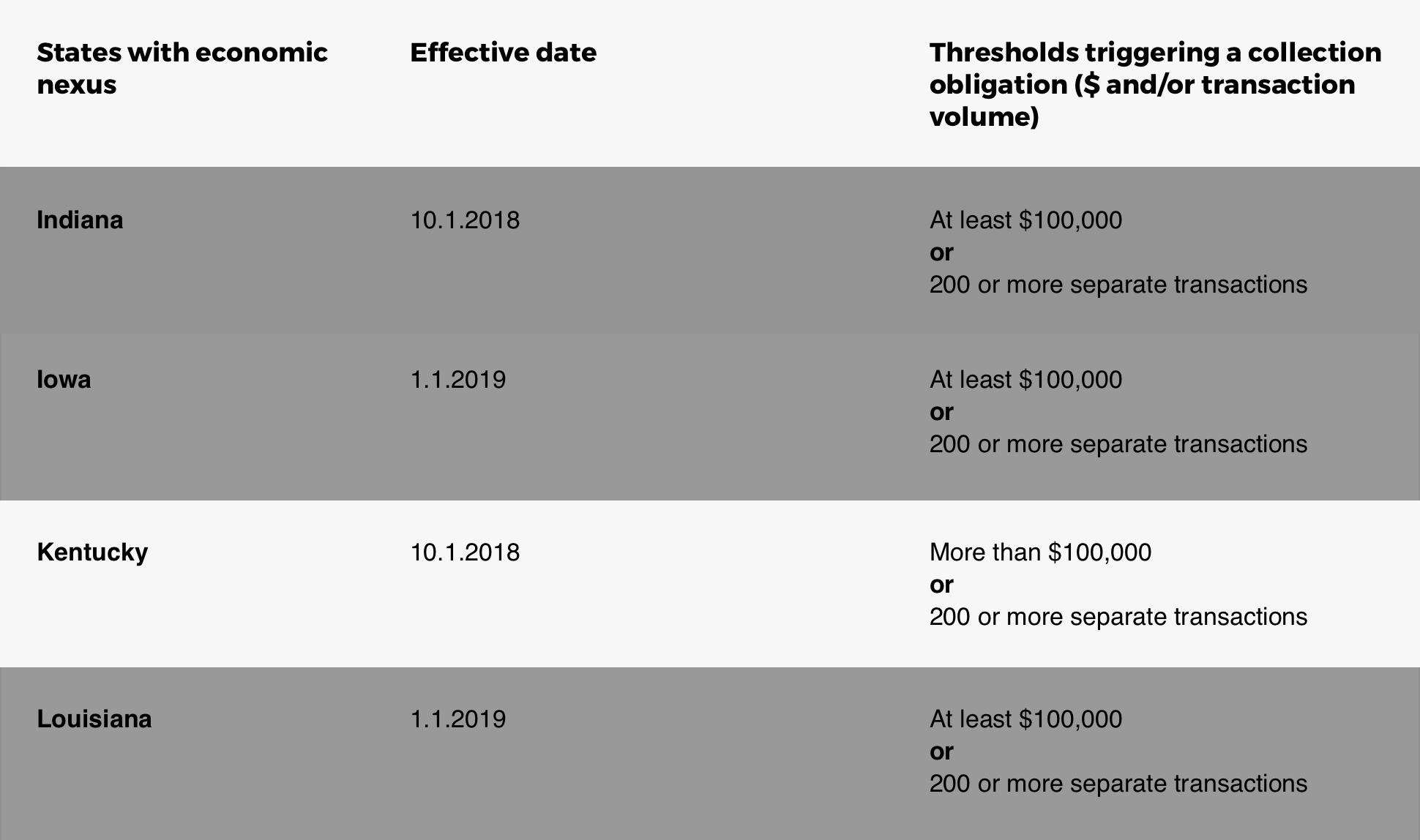

The Wayfair case established that online sellers meeting state-defined thresholds, usually in either total revenue or number of sales transactions, can be required to collect and remit state taxes. The decision triggered the enforcement of many existing laws, and with few exceptions, new nexus laws are in effect as of January 1, 2019. Knowledge of tax requirements in the states in which you do business is vital to answering the question – “Do I need to charge sales tax on my website?”

Economic nexus changes to eCommerce sales tax rules in Kentucky became effective October 1, 2018. According to the law, sellers are required to collect sales tax online and register with Kentucky alone or within the streamlined system if they meet either of the following two thresholds:

A seller meeting any one of these thresholds is obligated to collect and remit Kentucky state sales tax, independent of the other. For instance, a business with over $100,000 in revenue is required to collect state taxes even if it has not performed more than 200 transactions. In addition, 200 transactions netting less than $100,000 still obligates the business to charge state sales tax.

It’s important that business owners are aware of current tax obligations as well as the upcoming changes to tax laws that will vary by state. Forix works with Avalara to offer expert solutions for interpreting Kentucky online sales tax rules, as well as requirements for other states.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.