Let’s Talk.

Start with a conversation. From there, we can build a plan.

The internet has had a tremendous impact on shopping. Far more frequently than in the past, people buy from companies that are not in their state. By the old rules, no sales tax was due in such an instance, but the Supreme Court has changed that. After the ruling in South Dakota v. Wayfair, Inc., physical presence is no longer a requirement to collect sales tax online.

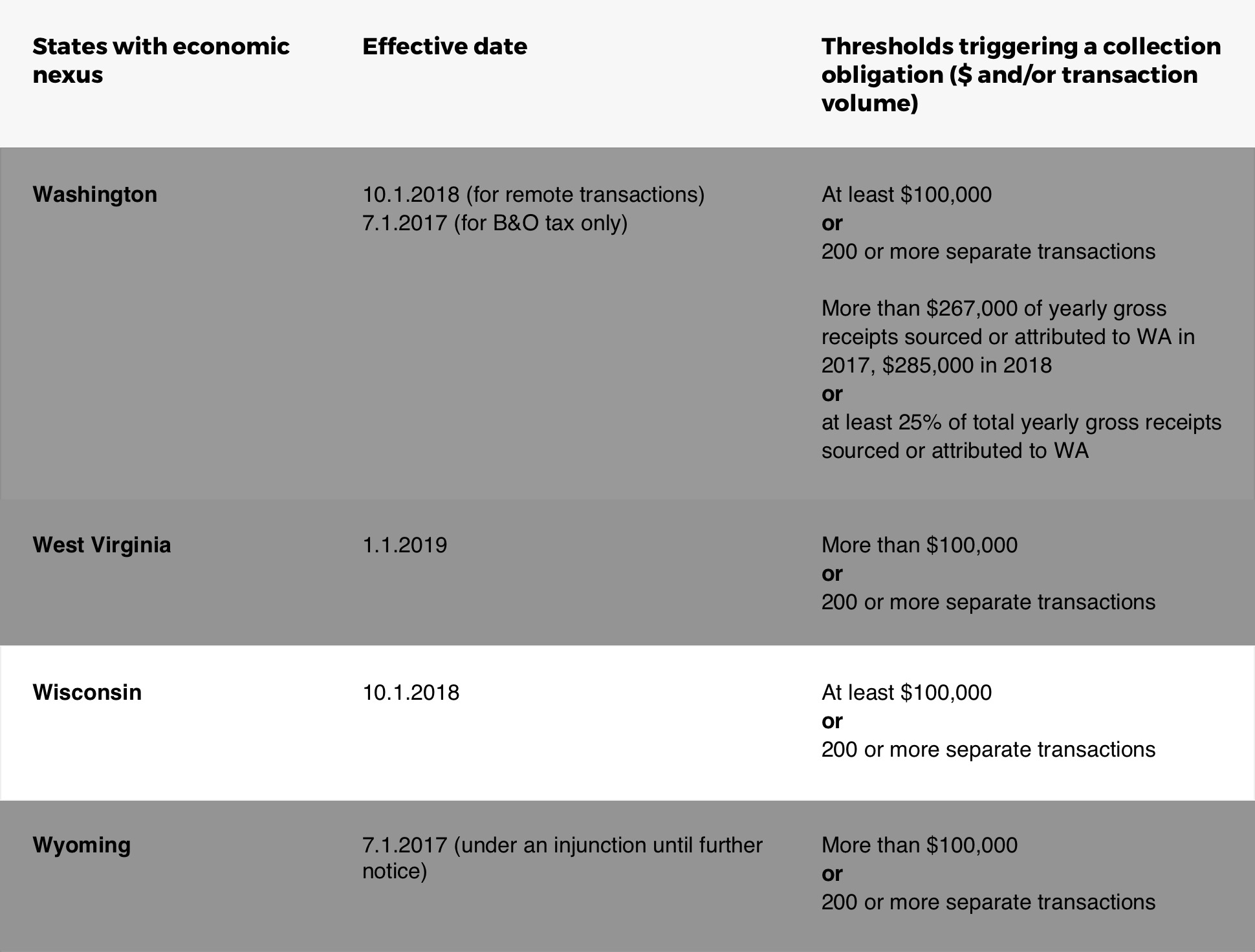

The majority of states along with the District of Columbia have made plans to take advantage of their broader powers to tax and most have already gone into effect. If you have out-of-state sales, you almost certainly need to start collecting sales tax for some of them.

Wisconsin is one of the states which has changed policy following the Supreme Court overturning the old law. Since 10/1/2018, eCommerce sales tax rules in Wisconsin require that any business with sales over $100,000 must collect sales tax online. Even if this threshold is not met, sales tax must be collected if a business conducts at least 200 separate transactions each year.

Online vendors need to apprise themselves of these changes. Keep in mind that these requirements are peculiar to the individual state; other states’ rules may vary. Nineteen states have yet to begin taxing online sales at all.

Compliance costs can severely cut into business profits. Keeping track of online sales tax rules for every jurisdiction by hand is a labor-intensive effort. Companies have entire departments dedicated to just this task.

Despite all precautions, even the best professionals can make mistakes. Knowing the Wisconsin online sales tax rules is only part of the game. When thousands of overlapping rules and regulations from municipalities are involved, it becomes exceedingly difficult to accurately record and collect sales tax online. Just one error can cost you thousands, too.

Online businesses need a better way to do business, and Avalara has just the thing. Their software integrates with each unique business and makes the process more efficient. Companies using Avalara have cut down on compliance costs, labor hours and entirely eliminated fines due to mistakes. Avalara completely gets rid of paperwork.

Over 20,000 companies all over the world have flocked to Avalara’s trusted name. They depend on Avalara to keep straight over 12,000 tax jurisdictions as well as the rule and regulations of millions of products and services. Avalara automatically takes the necessary steps for each and every sale generated.

Avalara’s software gathers the data for each sale and fills out the proper forms with it. It then files the form and remits the sales tax. Hundreds of thousands of times a year, Avalara software efficiently handles this process, taking the stress of doing online business off of their clients. If an auditor demands to see exemption certificates, Avalara has them ready and waiting to show full compliance.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.