Let’s Talk.

Start with a conversation. From there, we can build a plan.

Before South Dakota v. Wayfair, Inc. (2018), state sales tax was dependent completely on nexus, defined as a “sufficient physical presence” within a given state. An online seller was only required to charge state sales tax in a particular state if it had a physical presence, such as a shop, warehouse or employees there. However, the growth of internet-based sales caused many states to alter the definition of nexus.

Several states passed laws in an attempt to define nexus as an economic concept rather than physical. If a seller sold enough tangible product within a state to meet a given revenue or sales threshold there, they would establish an economic nexus rather than a physical nexus. However, many states did not enforce these laws until the federal government addressed the issue in 2018.

The Wayfair decision had widespread effects, including an impact on North Carolina online sales tax rules. The Supreme Court overturned the Quill Corp. v. North Dakota ruling that had defined nexus in physical terms and agreed that economic nexus represents a tie to a state as well. Online sellers are now subject to the state tax economic nexus laws in every state in which they do business.

The Supreme Court’s decision led to the enforcement of many of the existing state tax economic nexus laws. In addition, several states that hadn’t previously passed such laws did so after the decision; still others are set to take effect in the future. North Carolina is one of 31 states with new economic nexus laws.

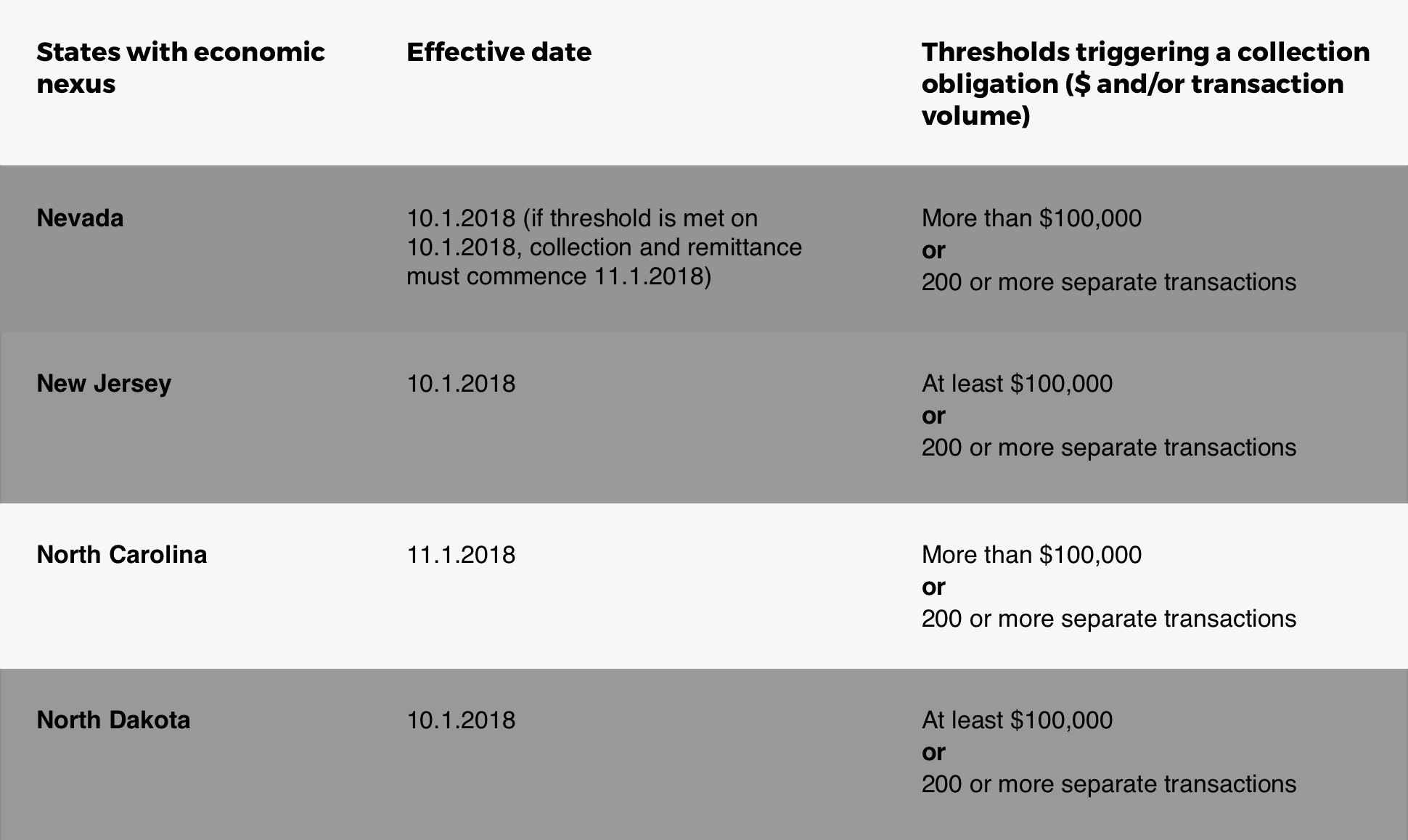

You can find a full list of states with economic nexus laws, as well as their various thresholds here.

North Carolina has already enacted its new economic nexus law, and the changes became effective November 1, 2018. Specifically, in order for an online seller to collect sales tax online in North Carolina, one of the following thresholds must be crossed:

It is important to note that only one of these thresholds must be met in order for a business to charge state sales tax. Simply put if sales transactions number less than 200 but revenue meets or exceeds $100,000, state taxes must be collected. Similarly, companies with revenue under $100,000 and making more than 200 separate transactions must also collect and remit state sales tax.

If you are an online seller that meets either or both of the above thresholds in the state of North Carolina, you must charge sales tax. Be aware that other states may specify different thresholds for this requirement, have established grace periods or currently await court proceedings. A seasoned tax professional like Avalara can be essential in determining your company’s state income tax requirements.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.