Let’s Talk.

Start with a conversation. From there, we can build a plan.

eCommerce has long been free of the obligations to which brick and mortar businesses were subject. This inequality has come to an end, at least in the majority of states. Before, if a company did not have a physical presence in a state, the state could not collect sales tax online. However, the Supreme Court of the United States has now ruled that physical presence is no longer a requirement for sales tax obligations.

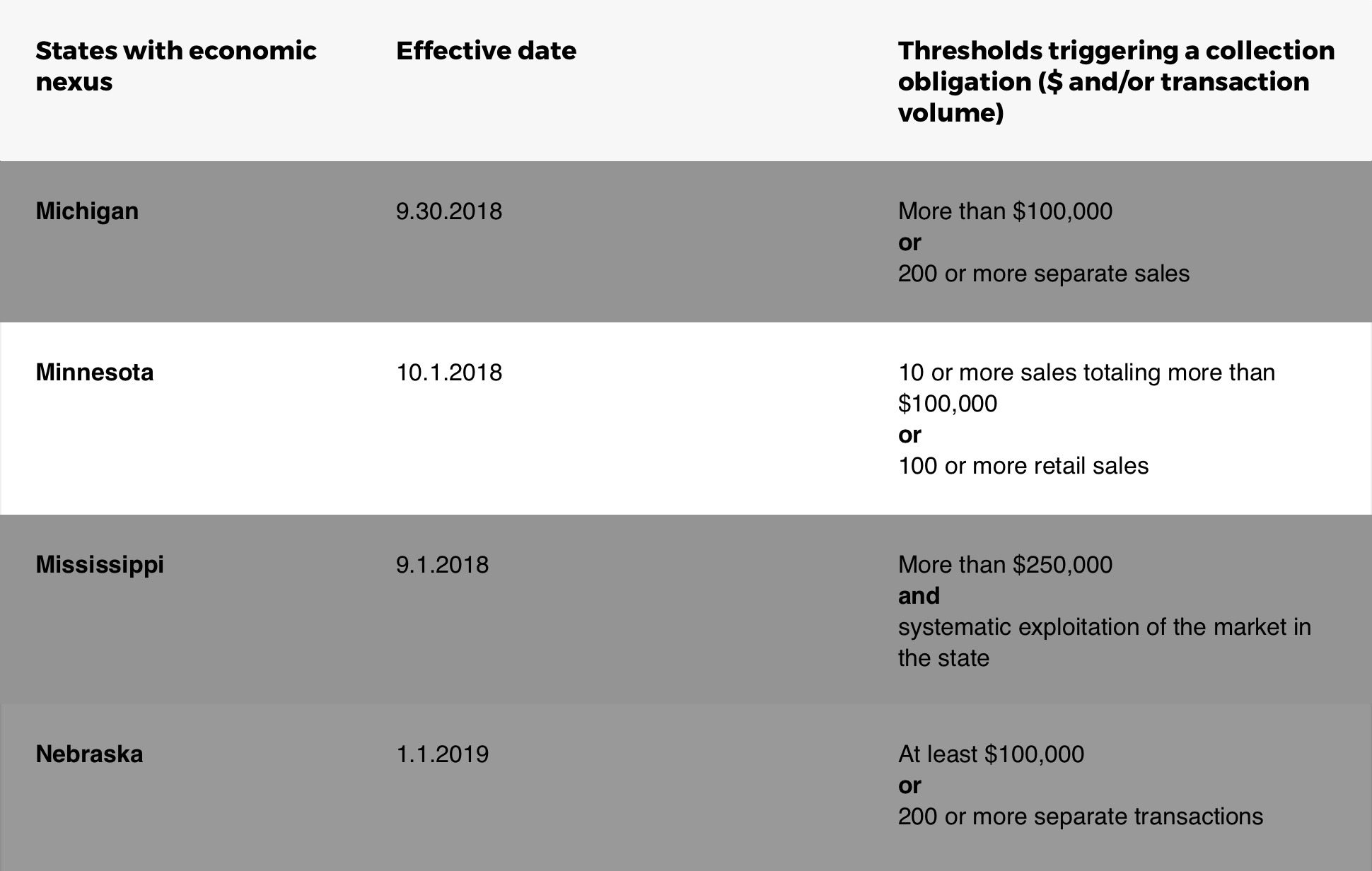

Most states have changed their policies, and many of them had already prepared new policies in anticipation of the South Dakota v. Wayfair, Inc. (2018) ruling. Do I need to charge sales tax on my website? For most states in which you sell, you probably do, but each state has their own laws.

Small online vendors who sell in Minnesota are not subject to any sales tax requirements, but eCommerce sales tax rules in Minnesota are stricter than in many other states. Since October 1, 2018, any vendor with 100 or more retail transactions must collect sales tax online. If the vendor has 10 or more sales but fewer than 100, they must still collect the tax as long as their total sales meet or exceed $100,000.

These requirements are for Minnesota only. Other states may have different requirements and some states have no requirements at all. Be sure to take note of the specific requirements of each state.

Keeping track of sales tax by hand is time-consuming. It’s a slow process that can reduce your profits. Every employee you have to hire to oversee compliance is less labor you have available for the actual business of satisfying customers.

Human error is prevalent whenever forms are filled out by hand. This is true even in the simplest of situations, but online sales tax is complex. There are thousands of different jurisdictions. Each state has its own, and each state has multiple municipalities with their own rules and regulations. Minnesota online sales tax rules differ from many other states, and each city in Minnesota can have its own ideas as to how to collect sales tax online. Any mistake uncovered during an audit is another burdensome cost to a company.

There is one solution that solves all these problems at once. Computers can keep track of the multiple jurisdictions, the hoard of rules and regulations, and can do it without the element of human error. More than 20,000 companies across the planet have chosen to automate their sales tax obligations by adding Avalara to their business.

Avalara software integrates with your business in a seamless, pain-free way. It can keep track of sales tax records without the need for paperwork and without the cost of human error. In over 12,000 jurisdictions and for millions of goods and services, Avalara makes the right decision, saving you time and energy.

That’s not all – Avalara also gathers the data from your sales and fills out the necessary forms electronically. It files the forms and handles the sales tax remittances. It even maintains a record of your exemption certificates.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.