Let’s Talk.

Start with a conversation. From there, we can build a plan.

In the past, state sales tax was determined by nexus – a business’s physical tie to a state that often took the form of a storefront, warehouse, employee or employees operating within a state. If a seller maintained any of these ties to a state, physical nexus dictated that the business must collect and remit state sales taxes. However, the rise in internet sales prompted several states, including Tennessee, to pass laws challenging this concept.

These laws attempted to establish nexus on an economic basis instead. Economic nexus supports the idea that a business holding significant economic interest in a state has established an economic nexus and should charge and remit state sales taxes. Tennessee passed a law intended to take effect on July 1, 2017; however, the Tennessee General Assembly immediately passed legislation prohibiting its enforcement until a similar case in South Dakota was settled.

South Dakota v. Wayfair, Inc. (2018) was a landmark decision that overturned the previous physical nexus ruling. As a result, businesses selling online are subject to the sales tax economic nexus provisions passed by each individual state. However, even after Supreme Court action, laws regarding Tennessee online sales tax rules remain under an injunction.

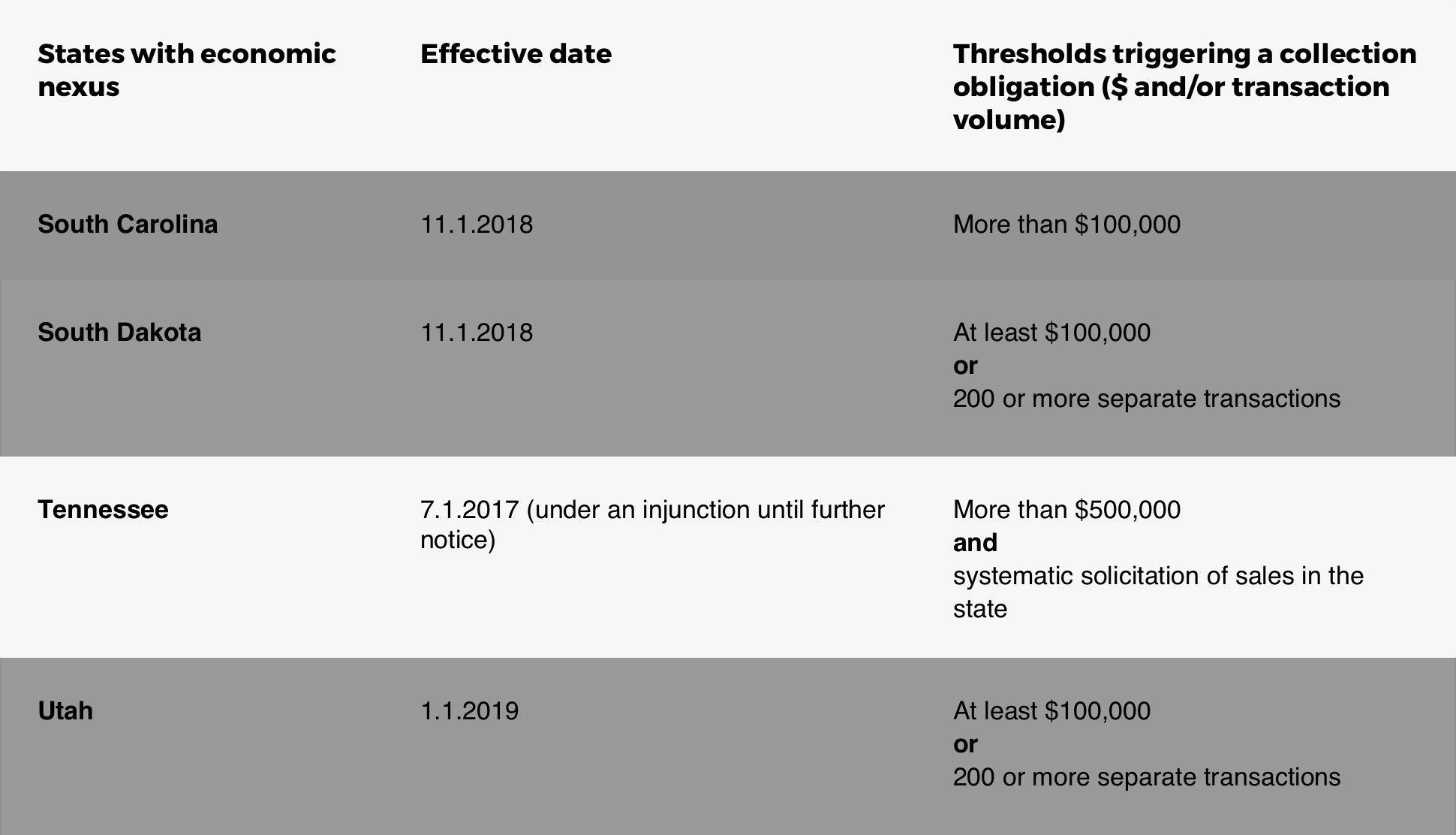

Tennessee was not alone in suspending its laws or refraining from enforcing them. In fact, this was the case for most other states, with many enacting their laws after the ruling took place and still more passing resolutions in the weeks and months that followed. Since the ruling, a total of 31 states have passed or enforced state tax economic nexus laws.

For a comprehensive list of all states with changes to economic nexus similar to South Dakota’s, see Avalara’s detailed chart here.

Laws regarding state sales tax in Tennessee remain limited to those businesses maintaining a sufficient physical presence in the state. For now, online sellers are not subject to state sales tax, pending injunction. In addition, it does not appear that Tennessee intends to retroactively tax online sales even after legislation is complete.

For future reference, the future economic nexus law states that in order to collect sales tax online in Tennessee, a business will need to have revenue exceeding $500,000. In addition, the business also must be determined to be systematically soliciting sales in Tennessee through any means. These means commonly include solicitation by mail, catalog, television or internet advertising, commercial internet sites, and others.

If you are an online seller that consistently solicits sales in Tennessee and regularly reaches $500,000 in revenue, you may be affected by Tennessee state sales tax in the future. In addition, other states specify different thresholds and are currently enforcing economic nexus laws. A seasoned tax professional like Avalara can offer streamlining of state sales tax information and help you determine your liability.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.