Let’s Talk.

Start with a conversation. From there, we can build a plan.

State sales tax nexus is a term the business world is talking about – and for good reason. New changes to the way in which businesses determine state sales tax have had widespread effects for online sellers in many states, and with more on the way, now is the time to get informed. What are these changes, and what might they mean for your business?

Prior to 2018, businesses operating within a storefront or online needed to have a physical tie to a state in order to charge and remit state sales tax there. Something such as a brick and mortar location, a warehouse, or one or more employees established a nexus, or a “sufficient physical presence” in a state. However, with the rise of online retail, many states passed laws in an attempt to make economic nexus a sufficient tie to a state as well.

With South Dakota v. Wayfair (2018), the Supreme Court overturned the idea of a purely physical nexus in favor of the concept that online retailers with a certain amount of revenue or a certain number of sales in a state that had established a nexus of an economic nature. This meant that online sellers without a physical presence in a state were still responsible for charging and remitting state taxes so long as they met an economic threshold in a particular state. As a result, laws in numerous states have changed, including those governing Nevada online sales tax rules.

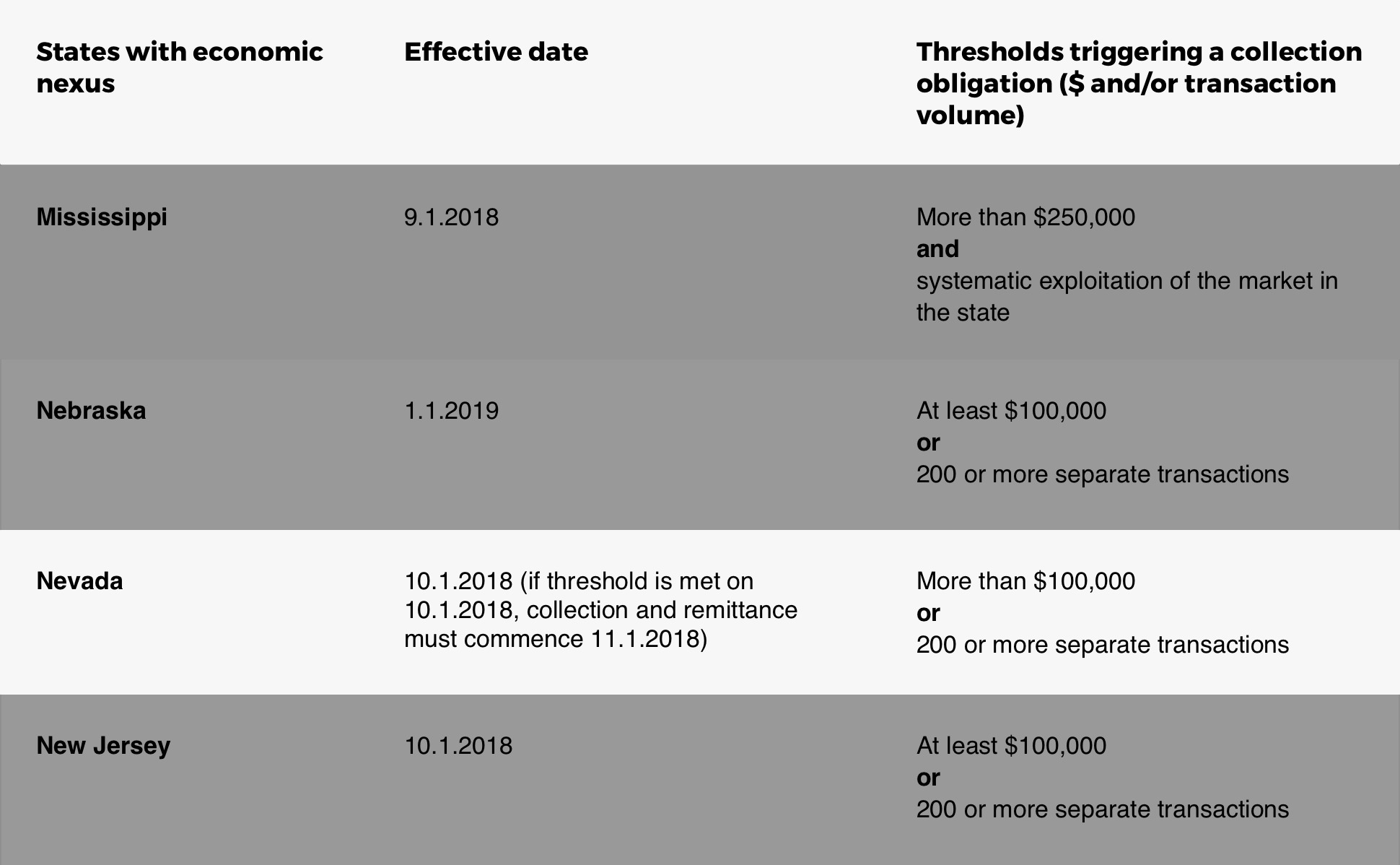

The Wayfair case prompted many states that already had economic nexus laws to begin enforcing them. Other states quickly passed their own laws, while still others will go into effect in the upcoming months. Nevada is one of the 31 states with laws regarding economic nexus state sales tax.

You can find Avalara’s complete list of all 31 states with new or upcoming economic nexus laws here.

New eCommerce sales tax rules are in effect for Nevada as of October 1, 2018. According to the new law, a business must reach one of the following thresholds for the previous calendar year in order to collect sales tax online:

In Nevada, each threshold is independent. For instance, an online seller with revenue of over $100,000 must charge state sales tax regardless of how many transactions were completed. Similarly, a business with 200 or more separate transactions must charge and remit state sales tax even if their revenue was under $100,000.

You will need to charge and remit state sales tax in the state of Nevada if your online business meets one of the thresholds mentioned above. In addition, you may be liable for taxes in one of the other 31 states with economic nexus laws. Avalara has the resources to streamline your state tax requirements and ensure that your business remains compliant.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.