Let’s Talk.

Start with a conversation. From there, we can build a plan.

Sales tax nexus is a term anyone selling a product should be familiar with because changes in sales tax requirements can add another layer to the cost of doing business. Generally speaking, “nexus” refers to the idea that a business must have some sort of tie to, or presence within, a state before charging and being required to remit sales tax there.

Previous federal law regarding nexus was established by Quill Corp v. North Dakota (1992) and stated that this presence must be physical, such as a retail store, warehouse, or employees. In fact, nexus was also referred to as “sufficient physical presence.” However, with a 2018 Supreme Court ruling, everything changed.

With its ruling in the case of South Dakota v. Wayfair, Inc (2018), the Supreme Court overturned the previous ruling that sales tax nexus must be established physically. Instead, both economic and virtual connections to a state such as online sales of goods to be shipped into the state, are considered grounds for nexus. Simply put, if your business crosses the economic threshold for a state and establishes sufficient economic nexus, you must collect and pay sales tax there even if you have not established a physical presence.

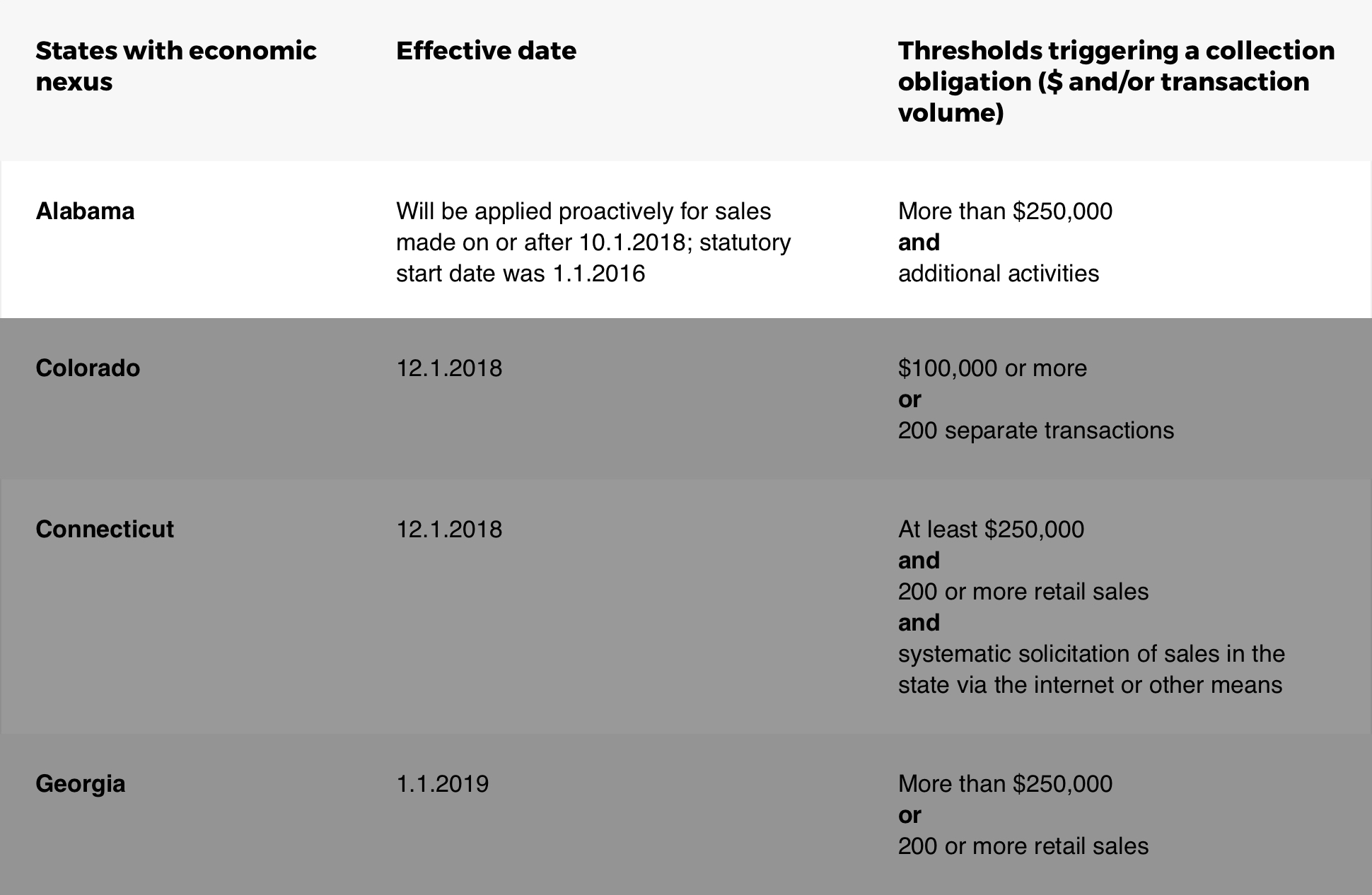

Many states had already established their own sales tax nexus laws and several more did so after the Wayfair ruling. The effective dates for these laws vary widely, with some taking effect in conjunction with the June ruling, others set for a future date, and still others set to be triggered by legislative action. For online retailers doing business in numerous states, it is important to stay up to date regarding sales tax laws in each state.

New ecommerce sales tax rules in Alabama took effect October 1, 2018 and state that to collect sales tax online in Alabama, a business must:

These activities generally include things like advertising or soliciting via mail, catalog, television, or call center within Alabama, employing a canvasser or door to door salesperson within the state, operating as a franchise or via a licensee, or soliciting orders via telecommunications. In other words, if you solicit business in Alabama regardless of whether or not your business has a physical presence there, you may be legally obligated to charge and remit sales tax.

With economic nexus laws on the books in 31 states – and a multitude of rules, thresholds, and effective dates – determining whether your business must collect sales tax online can be a chore. Alabama in particular supplies a host of other qualifications for nexus that may affect your business. Avalara can help you determine your tax liability in this and other states, and offers a variety of services for your every tax need.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.