Let’s Talk.

Start with a conversation. From there, we can build a plan.

The Supreme Court ruling in Quill Corp. v. North Dakota. (1992) defined sales tax nexus – a company’s bond to a particular state that requires it to charge and remit sales tax – as a literal physical presence within that state. By definition, this could take the form of a brick-and-mortar location, a supplier’s warehouse, or even an employee or group of employees residing in the state.

However, with the subsequent advent of online retail sales and the staggering growth of companies such as Amazon in the years since, some states began to enact their own laws defining nexus as an economic presence. With South Dakota v. Wayfair, Inc (2018), the Supreme Court overturned the Quill decision requiring a physical presence in a state. Instead, it was determined that businesses selling tangible products to residents of a state may have established an economic nexus and must collect and remit state sales tax.

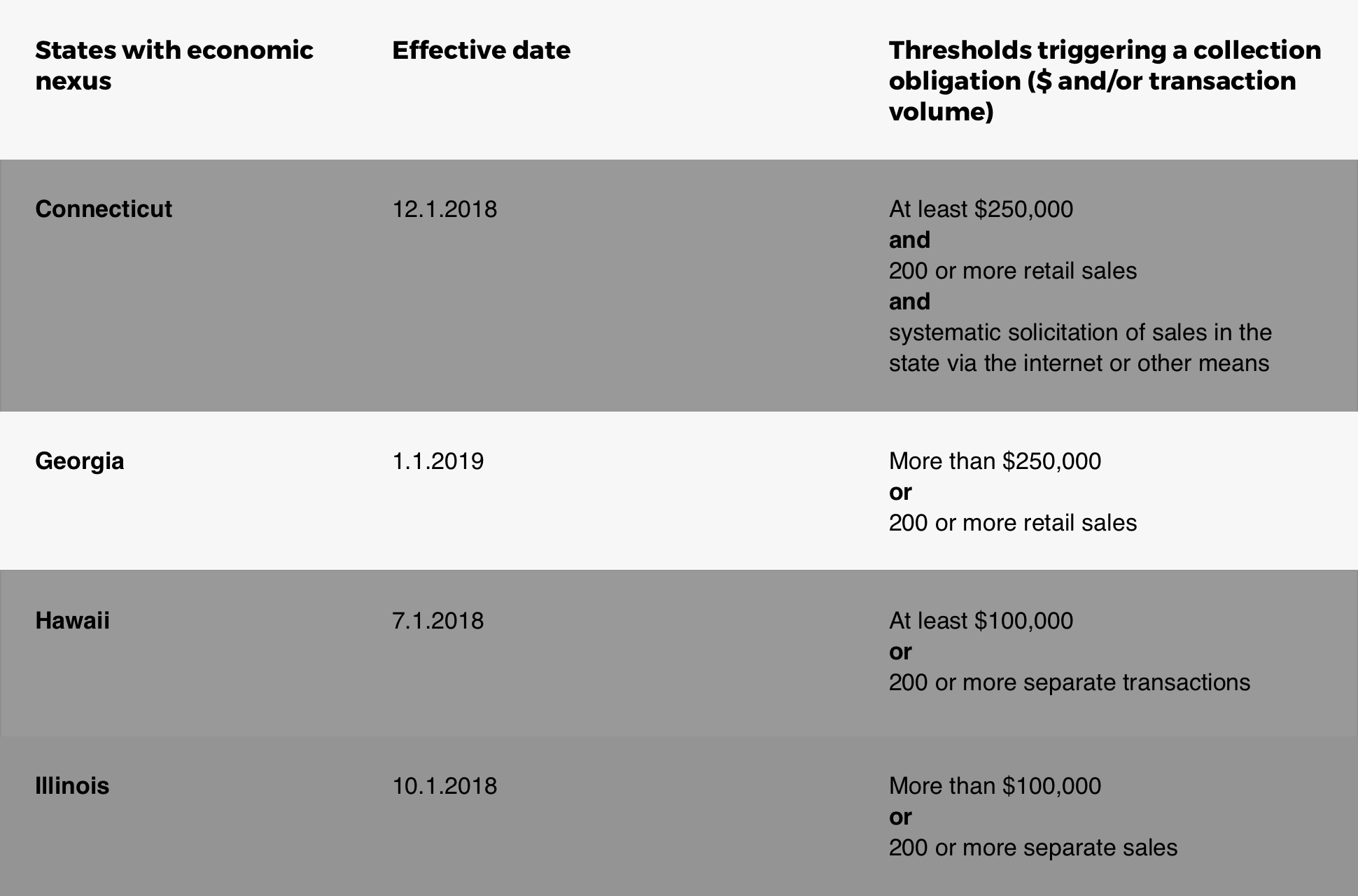

Several states had already established their own laws regarding economic nexus, but many awaited the Supreme Court decision in the Wayfair case to make changes. After the decision, some states quickly passed laws, while others took effect recently or after further legislative action. Since the laws and their effective dates are determined individually, they vary by state.

New ecommerce sales tax rules in Georgia went into effect as of January 1, 2019. Current Georgia law requires businesses to collect sales tax online if they meet either of the following thresholds:

As stated, either of these thresholds are enough to require a business to collect and remit sales tax in Georgia. For example, even if a business does not make 200 sales transactions, simply having a revenue of over $250,000 is still enough to require it to charge sales tax. Similarly, crossing the 200 sales threshold establishes economic nexus even if total revenue in the state is under $250,000.

It is important to note that Georgia is one of the few states that gives online retailers a choice – either collect state sales tax or comply with non-collecting seller reporting requirements. These requirements involve notifying purchasers they may still be subject to Georgia taxes, sending a use tax statement to each purchaser totaling $500 or more, and filing non-seller use tax statements for each.

If you do business in Georgia and meet one of the above qualifications for revenue or sales transactions, you will need to either collect sales tax online in accordance with the new Georgia online sales tax rules, or comply with the other reporting requirements. Forix can guide you in making this and other tax-related decisions, as well as offer full-scale tax solutions.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.