Let’s Talk.

Start with a conversation. From there, we can build a plan.

The discussion about state sales tax liability for online businesses is an ongoing one that continues to evolve as the way we conduct business continues to change. In Quill Corp. v. South Dakota (1992), the Supreme Court ruled that businesses must establish a nexus, or tie, to a state in order to be compelled to charge sales tax there. This meant that only businesses with a physical location, warehouse, or employees within a state were required to comply with the ruling. However, the drastic spike in online business caused a number of states to consider other factors to determine nexus.

These states determined that online sales constituted a business’s tie to a state, resulting in an economic nexus even if the business held no physical property there. Subsequently, laws were passed in some states in an effort to collect sales tax for online sales. In the absence of a federal decision, however, not many of the laws were enforced.

South Dakota v. Wayfair, Inc. (2018) overturned the Quill decision and changed the way in which businesses view sales tax. As a result, a business’s ties to a state no longer need to be physical. Instead, sellers of online goods can establish an economic nexus, requiring them to collect and remit state sales tax, provided they meet certain thresholds as outlined by that state.

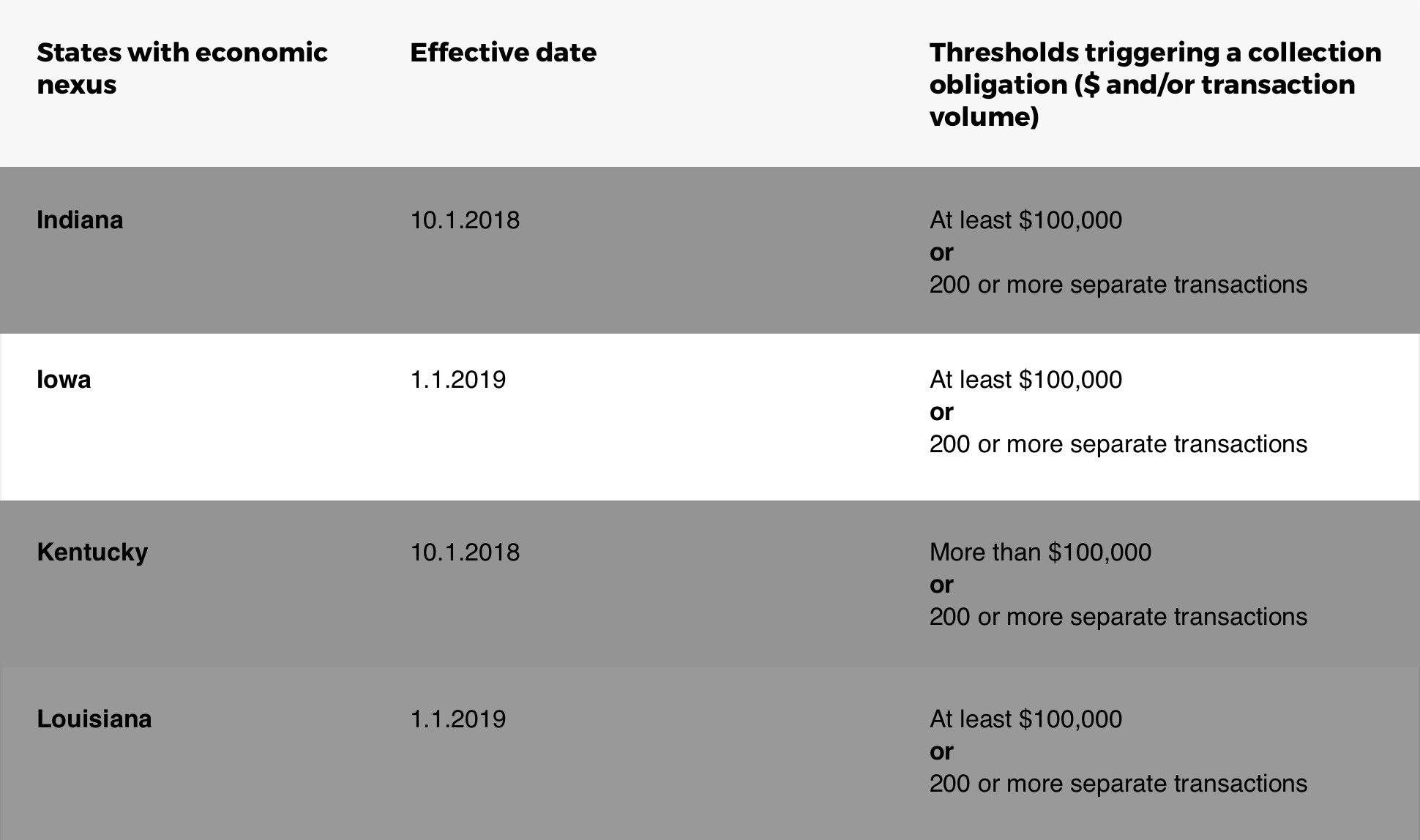

After the 2018 Wayfair decision, many states that had already passed economic nexus laws began to enforce them. Others have passed laws since then, and still more states stand to enact laws in 2019. These variations in state sales tax economic nexus laws can pose a problem for online sellers who perform transactions in many states.

Although the laws were previously passed, changes to eCommerce sales tax rules in Iowa did not go into effect until January 1, 2019. Retailers must collect sales tax online if they meet either of these two thresholds:

These two thresholds operate independently of each other. Simply put, if an online seller has revenue of $100,000 or more resulting from fewer than 200 transactions, they are still required to collect Iowa state sales tax. The reverse is true, as well – a seller completing over 200 transactions is required to collect and remit state sales tax even if their total revenue is under $100,000.

You must collect sales tax online if your business sells a tangible product, certain digital goods, or certain services to Iowa residents and meets either of the above thresholds. Since economic nexus state tax laws vary state by state, tax requirements for online sellers selling in multiple states can become complicated. The help of a seasoned tax compliance expert such as Avalara can be essential when it comes to determining the state taxes that apply to your business.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.