Let’s Talk.

Start with a conversation. From there, we can build a plan.

Before the advent of the internet, a business needed a physical presence in a state to be subject to that state’s sales tax laws. This meant that if a business had a warehouse, physical storefront, or employees living in the state they were required to collect and submit state taxes. With the surge of online businesses states began to rethink their requirements. Recently, the Supreme Court of the Unites States overturned the physical presence rule. In South Dakota v. Wayfair, Inc. (2018), “economic and virtual” connections to the state were found to be sufficient grounds for “nexus,” or the obligation to collect sales tax online.

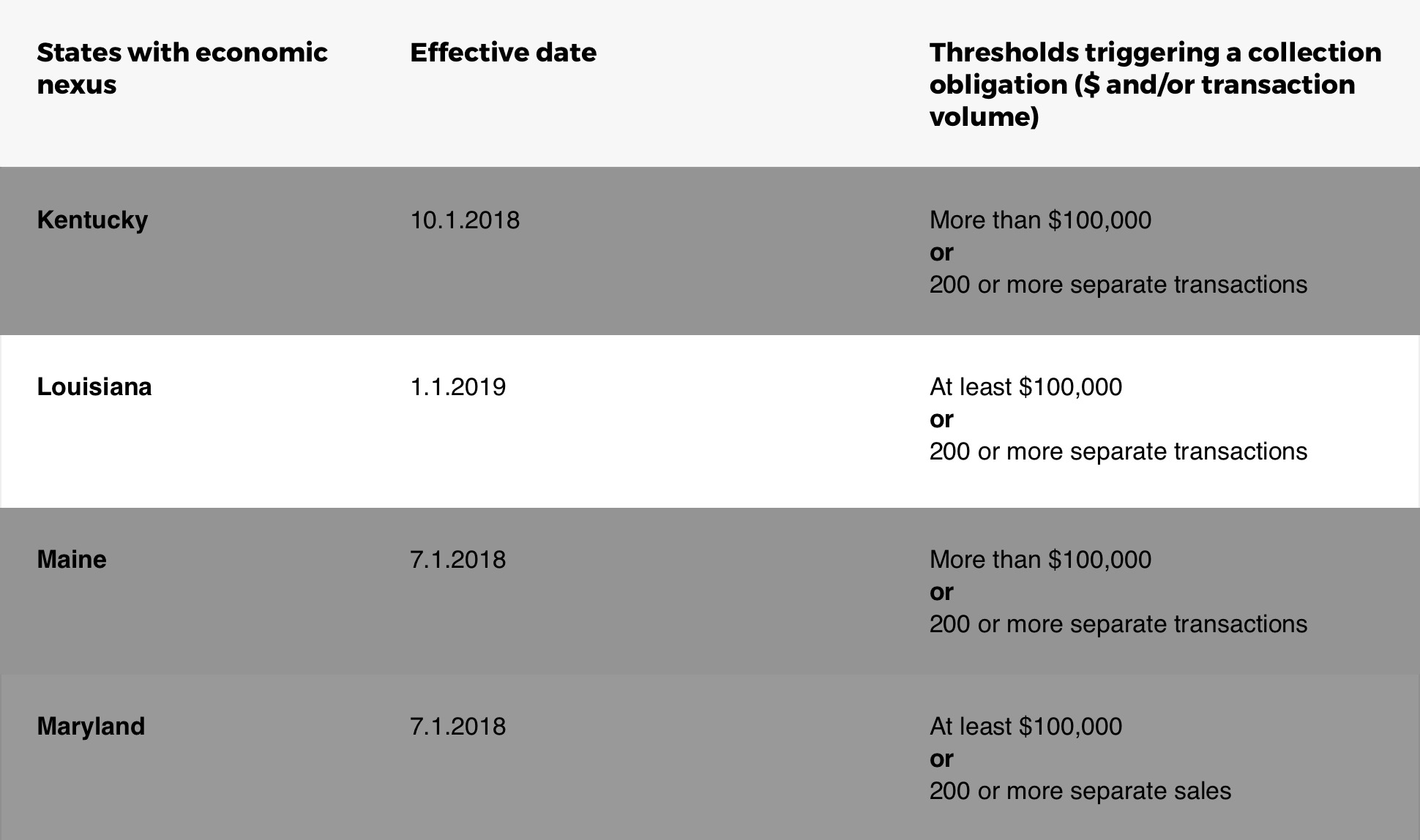

Thirty-one states plus the District of Columbia have or will soon have online sales tax requirements for companies doing business in their state. It is important as a business owner to understand these new tax laws. Do I need to charge sales tax on my website?

Any company that sells products online to customers in Louisiana must take note of these changes. New eCommerce sales tax rules in Louisiana took effect on January 1, 2019. Any business that has 200 or more separate transactions in Louisiana will have to collect sales tax online. Any business with fewer than 200 separate transactions but with more than $100,000 worth of sales will also have to collect the sales tax.

These rules apply to Louisiana. Other states have different thresholds for online sales tax collection and the time frames for their implementation may vary widely, so it is important to stay up to date on these changes.

Compliance costs are a large part of business and can really eat into profits. Often companies have to hire entire departments just to handle this aspect of their business. Keeping track of sales tax by hand is a slow and laborious process.

This difficulty is compounded by the fact that there are many thousands of tax jurisdictions, each with their own rules, regulations and tax rates for when and how companies must collect sales tax online. Louisiana online sales tax rules can differ from other states, and municipalities within Louisiana have their own standards on top of the state regulations. Any mistake caught during an audit can mean thousands of dollars in fines.

What online vendors need is sales tax automation. If record keeping is streamlined by computers, businesses keep costs down and drastically cut back the time spent on compliance. Forix partner, Avalara, is a trusted name that has successfully taken this burden off more than 20,000 companies all around the world.

Avalara’s tax automation solutions integrate with your business seamlessly to keep track of your sales tax obligations with our specially designed software, without the need for human paperwork. It automatically makes the right sales tax decision in over 12,000 jurisdictions and for millions of different products and services.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.