Let’s Talk.

Start with a conversation. From there, we can build a plan.

The internet was a huge game changer for commerce. Buying and selling online exploded in popularity, and due to the physical presence interpretation of the Supreme Court ruling in Quill Corp v. North Dakota (1992) these sales were not generally subject to a sales tax. On June 21, 2018, the Supreme Court of the United States overturned the requirement for physical presence to collect sales tax online. This ruling forever changed the nature of eCommerce.

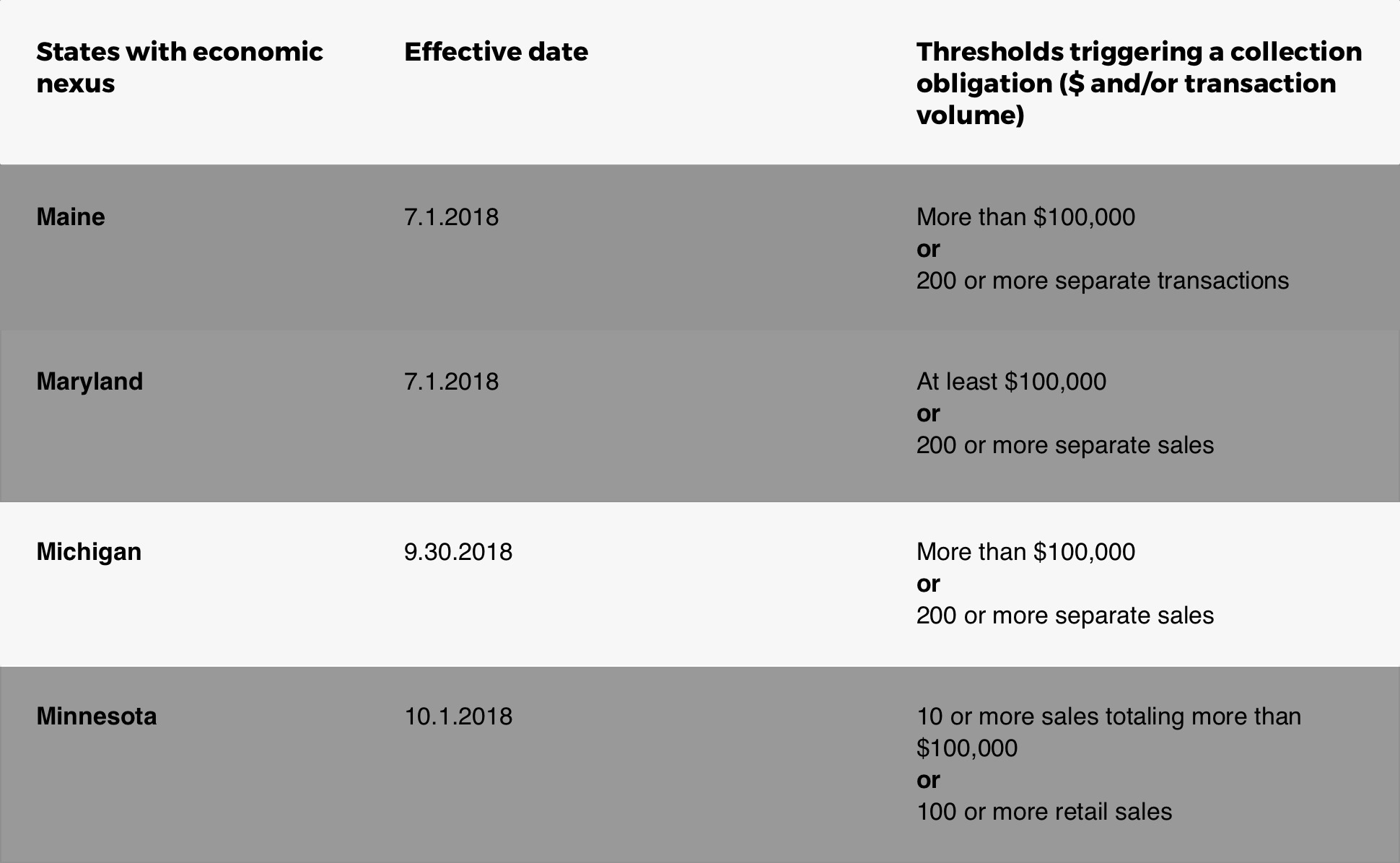

Most states have already reacted to the ruling, including the District of Columbia. In the new world of eCommerce, online sellers will have to be aware of the sales tax rules for each state in the union. This has many entrepreneurs wondering; do I need to charge sales tax on my website?

On September 30, 2018, new eCommerce sales tax rules in Michigan took effect. All online vendors who meet at least one of two requirements must collect sales tax online. If a business does $100,000 worth of sales per year in the state of Michigan, they are subject to the sales tax requirements. Even if this threshold is not met, if the business conducts at least 200 separate sales transactions in the state, they are still obligated to collect and submit sales tax.

Online sales tax rules vary from state to state, and some states still do not have any online sales tax. Companies must be sure to take note of the specific requirements in the states in which they are conducting business.

Compliance costs can eat into your profits. Companies often have to hire many employees to handle things like sales tax. The business world moves at a lightning pace but record keeping by hand slows you down.

It also makes you susceptible to human error. We can fill out even the simplest of forms wrong, but with online sales taxes you’ll be trying to understand the differences between thousands of tax jurisdictions, keeping multitudes of rules and regulations straight and remembering when they apply. Michigan online sales tax rules are specific to Michigan. There may be additional local jurisdictions for which you must collect sales tax online. A single mistake can cost you thousands during an audit.

Automation makes everything simpler. Computers streamline record keeping, thus allowing businesses to cut costs and labor hours. Over 20,000 companies, worldwide, have turned to Forix partner, Avalara, for the best solution to online sales taxes.

Avalara’s software is designed to effortlessly integrate with your business. In over 12,000 tax jurisdictions and for millions of goods and services, Avalara makes the right decision every time. It also fully automates the filing and remittance of sales tax obligations. It gathers the data, fills out the forms and files them away, taking the stress off your business. It does this hundreds of thousands of times a year. Just in case of an audit, it records your exemption certificates so they are ready at a moment’s notice.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.