Let’s Talk.

Start with a conversation. From there, we can build a plan.

Economic nexus is a phrase that should catch the attention of any retailer, especially those that primarily do business online. A recent Supreme Court decision has changed how states determine sellers’ responsibility to charge and remit state sales tax. Simply put, if you weren’t required to charge online sales tax before 2018, you may be soon.

Previously, businesses were only required to charge online sales tax if they maintained a “sufficient physical presence” within that state. Usually, the term sufficient physical presence was defined by the ownership of an office, storefront, warehouse, or set of employees within a state. However, the advent of internet shopping and the subsequent rise in online sales prompted several states to seek lost sales tax revenue by changing the very definition of nexus.

South Dakota v. Wayfair (2018) overturned the Supreme Court’s previous ruling that required physical presence for state taxes. Instead, individual state tax laws can determine a business as having a significant economic interest in a state, or economic nexus, if it meets certain thresholds. As a result, Vermont online sales tax rules, amongst other rules in a variety of states, have experienced significant changes.

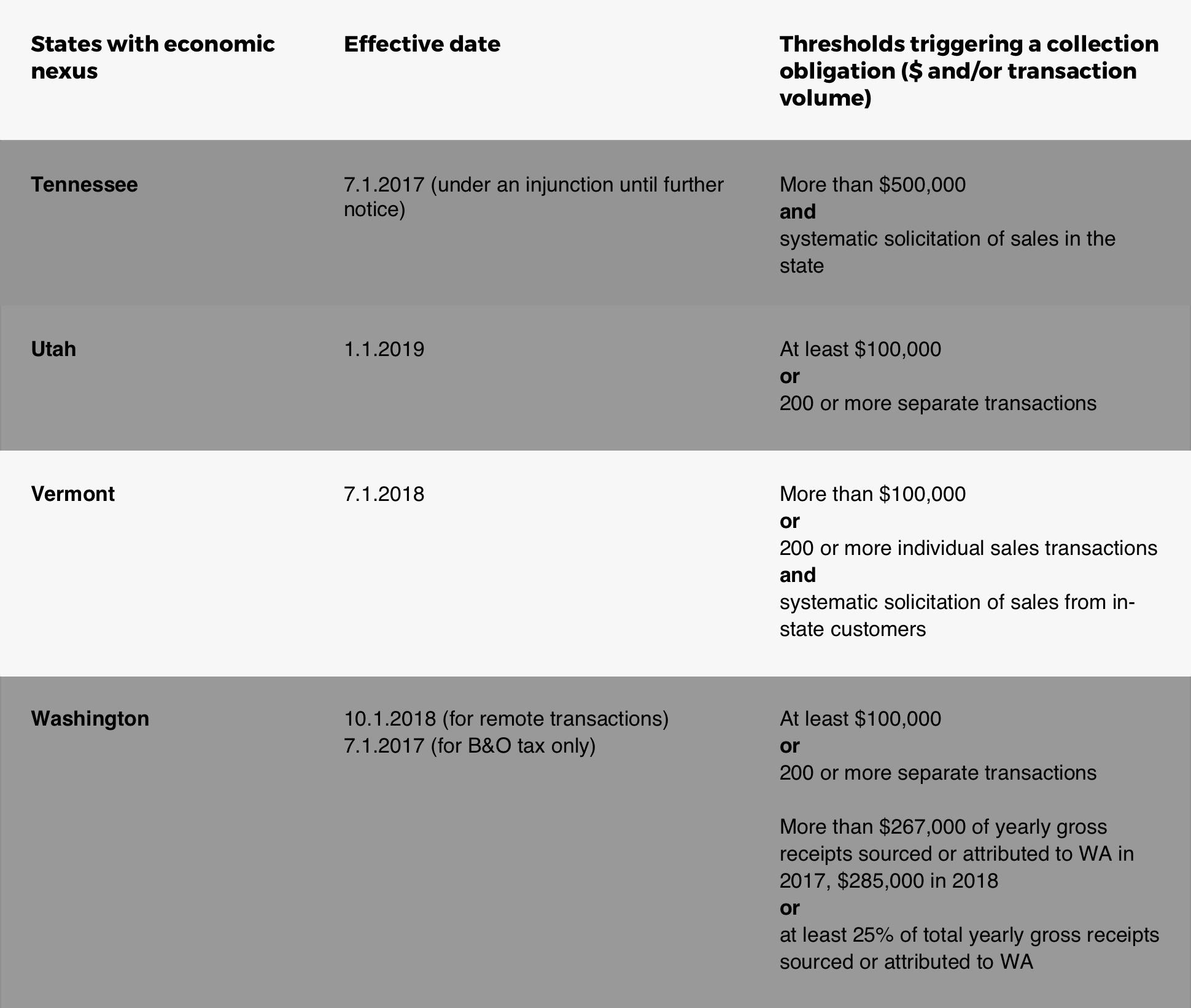

After the Wayfair ruling, most of the states that had previously passed legislation set effective dates for the rules. Others quickly passed their own laws or are awaiting further legislation. In total, 31 states passed economic nexus laws, including Vermont.

For a comprehensive list of each economic nexus state along with its respective revenue or transaction thresholds, see Avalara’s state nexus law page here.

Vermont’s online state sales tax economic nexus law became effective as of July 1, 2018. It states that, in order for a business to collect sales tax online in Vermont, the business must meet one of the following thresholds:

The business must also systematically solicit sales from in-state customers Systematic solicitation can be defined as regular or seasonal advertising in the state. This can include print, radio, television, or internet ads, as well as distributing fliers, catalogs, magazines, or communication by phone or internet.

It is important to note that Vermont does not require both economic thresholds to be met. Revenue of $100,000 or more is sufficient to require state sales tax even if 200 sales are not met. Similarly, if there are 200 individual sales, the business must charge sales tax regardless of revenue.

If you are an online seller of a tangible good that meets the above thresholds for the state of Vermont, you must charge sales tax. Other states specify different thresholds or may have instituted a grace period. The professionals at Avalara can help you determine your business’s tax liability in each of the economic nexus states and streamline your state tax obligations.

Disclaimer: The information in this blog post is provided for general informational purposes only and should not be construed as legal advice from Forix or Avalara.

Start with a conversation. From there, we can build a plan.